Vermont Sales Tax & Audit Guide

Straightforward Answers to Your Vermont Sales Tax Questions.

- Do I need to collect Vermont Sales tax?

- Should I be collecting or paying the Vermont Use tax?

- What do I do if I should have been collecting but haven't?

- I received an audit notice. What should I do?

- Guidance on fighting a sales tax assessment in West Vermont.

Who Needs to Collect Vermont Sales and Use Tax?

If your business sells tangible personal property taxable in Vermont, you must charge, collect, and remit sales tax to the Vermont Department of Taxes. A seller must collect Vermont sales tax on tangible personal property at the time and place of the sale. If your business makes purchases subject to sales tax but is not charged, then use tax is imposed on your purchases.

This applies to those who open an online business in Vermont. If your online business provides taxable products or services, you must obtain a sales/use tax license and follow all the statutes that apply to a store-front business.

How is Nexus Established in Vermont?

Any entity that meets one of the following definitions for a vendor must license to collect and remit sales tax:

An entity making sales of tangible personal property from outside the State of Vermont to a destination within the state but who does not maintain a place of business or other physical presence in the State that:

Engages in the regular, systematic, or seasonal solicitation of sales of tangible personal property in the State:

By the display of advertisements in the State.

By the distribution of catalogs, periodicals, advertising flyers, or other advertising through print, radio, or television media; or

by mail, telephone, internet, computer database, cable, optic, cellular, or other communication systems, to effect sales of tangible personal property; and

Has made sales from outside the State to destinations within the State of at least $100,000.00 or totaled at least 200 individual sales transactions during any 12-month period.

A person with any other contact with the State that would allow the State to require the seller to collect and remit use tax under the Constitution and laws of the United States.

Economic Nexus (Wayfair Law) and Internet Sales in Vermont

Businesses with no physical presence in Vermont can establish economic nexus by exceeding the sales threshold listed in the above section.

A remote seller or a marketplace facilitator who establishes no physical nexus but who meets either of the following requirements during any preceding twelve-month period:

Gross revenue from the sale of tangible personal property, admissions, or services delivered into Vermont that exceeds one hundred thousand dollars ($100,000.00); or

Two hundred or more separate transactions for delivery into Vermont.

Marketplace Sellers

If all your sales in Vermont are conducted via a marketplace facilitator's platform, you are what is considered a "marketplace seller" and do not need to register to collect Vermont sales tax. Instead, your marketplace facilitator is responsible for the tax on sales through the marketplace.

How is the $100,000 gross revenue threshold calculated?

If you are a marketplace facilitator or remote seller, and you sold or facilitated the sale of more than $100,000 in annual gross revenue or 200 or more transactions to customers in Vermont in the previous or current calendar year, you must register to collect and pay Vermont sales tax.

Click Through Nexus

Retailers without a physical presence in Vermont who contract to advertise on websites of individuals or businesses located in Vermont and who sold more than $10,000 in taxable sales to customers in Vermont must collect the tax and remit it to the Vermont Department of Taxes.

Which Sales are Subject to Vermont Sales Tax?

General Transactions

If you have nexus in Vermont, the next step is determining whether the products or services you sell are subject to Vermont sales and use tax.

Unless an item is specifically exempt, sales and rentals of tangible personal property are subject to Vermont sales tax.

The rules seem simple, but many details make applying Vermont’s tax rules to your business challenging. We recommend scheduling a time to review your specific situation with one of our sales tax professionals.

Common Exemptions from Vermont Sales and Use Tax:

Items exempt from Vermont sales tax include:

- Clothing

- Over-the-Counter Drugs

- Feminine Hygiene Products

- Medical Equipment & Supplies

- Food, Food Products, and Beverages

Services

The Vermont Department of Taxes has different rules and rates depending on the industry and the type of service. Find information about sales tax on specific types of services below.

Software

Many people have questions about the taxability of software as a service (SaaS).

Many states already impose a tax on software as a service. As these options proliferate, states are moving to update their tax laws and, naturally, impose a tax.

To determine whether you need to collect tax on software sales, we highly recommend contacting one of our sales tax professionals to help you sort it out.

For now, we’ve summarized Vermont’s software tax rules here:

Software as a Service (SaaS)

Charges for remote access to prewritten software accessed solely through an internet or cloud platform are not taxable.

Custom Software

Custom software written exclusively for the customer’s business is exempt from tax.

Prewritten Software

Prewritten software on tangible storage media or downloaded from the internet is taxable.

Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Development and Technical Support Services

Under Vermont law, IaaS, PaaS, and technical support service development are non-taxable.

Shipping & Handling

If an item is taxable, then tax is also due on delivery and freight charges for delivery of the item.

If an item is tax-exempt, delivery charges are also exempt.

When shipping a package containing taxable and tax-exempt items, tax is due for shipping only the taxable portion of the order. The tax on delivery or freight charges may be applied based on the percentage of either the price or the weight of taxable items in the package.

Industry-Specific Guidance

While the general sales tax rules seem straightforward, applying those rules can get tricky when gray areas arise. The Vermont Department of Taxes provides some specific guidance for the following industries:

Determining Local Sales Tax Rates in Vermont

The sales tax rate at most locations in Vermont is 6%.

Vermont has authorized certain municipalities to assess a 1.0% local option sales tax, in addition to state sales tax. Local option sales tax is based on where the item is delivered.

Vendors within a municipality with a local option sales tax must collect the tax on in-store sales and sales of items shipped to local option sales tax municipalities.

Vendors outside municipalities with local option sales taxes must collect the tax on items shipped into municipalities with local option sales taxes.

Local Sales and Use Tax Tables

Here you can access local Vermont Sales tax rates or see the chart below for the total tax rates of the most populated Vermont cities.

*Exact tax rates vary. Occupancy fees and taxes are not included in this table.

I Should Have Collected Vermont Sales Tax, But I Didn't

Many of our competitors suggest Filing a Voluntary Disclosure Agreement in each state. This is a one-size-fits-all solution that isn't always the best. Our sales tax professionals will work with you to determine your business's best and most cost-effective solution.

If you determine your business has nexus, but you have not collected Vermont Sales tax, here are your options:

- Register and pay back taxes, penalties, and interest, or

- Complete a VDA to cut penalties (and, in some cases, reduce your tax liability and avoid interest).

Here is what you need to consider about each option to make the best decision for your business:

Option 1: Register to Pay Back Taxes, Penalties, and Interest

A VDA is not cost-effective if the past liabilities and penalties are minimal. Sometimes the best resolution for a business is to register with Vermont and pay back taxes, penalties, and interest.

Be wary of the tax professionals recommending a VDA in these cases. They want to make a buck rather than look out for your best interests.

When to consider registration and payment:

If you established nexus less than 3 or 4 years ago.

The sales tax penalty is LESS than the professional fees charged for the VDA.

Your business does NOT have a sales tax collected issue.

Beware: Registering does not generally end past liabilities.

If you're unsure what your past liabilities are, contact us. Our state tax professionals work with you so you can make the right choice for your business.

Option 2: Voluntary Disclosure Agreement (VDA)

West Vermont’s lookback period is three years.

In many situations, voluntary disclosures are a valuable tool to reduce extended periods of past exposure.

The voluntary disclosure limits the lookback period to three years. So, if you should have collected sales tax over the past ten years but didn't, you may benefit from doing a VDA.

A VDA may be a good option for you if:

You established nexus more than 3 or 4 years ago.

You have a sales tax collected but not remitted issue.

The sales tax penalty savings is MORE than the professional fees charged for the VDA.

What to Expect During an Audit

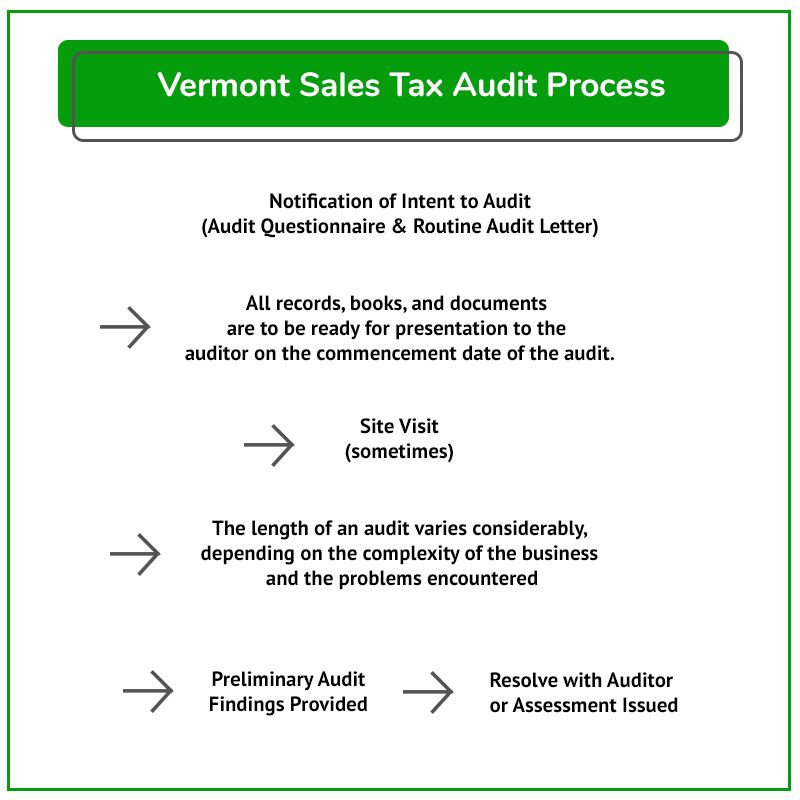

You can see the typical audit process shown in this flowchart. Detailed guidance for each West Vermont audit process stage follows in the sections below.

Vermont regularly audits businesses required to charge, collect, and remit various taxes in the state. Many audits begin with a call from a Vermont Department of Taxes sales tax auditor. Shortly after the call, your business will receive a Notification of Intent to Audit. This notification confirms that you were lucky enough to be chosen for a Vermont Sales tax audit.

Once the audit is complete, the auditor will send you the assessment and the amount.

It is good to start with getting a state and local tax professional involved to prepare for the audit.

I Received a Vermont Sales Tax Audit Notice. What Should I Do?

Businesses that receive a sales tax audit notice need to consider the following questions:

If you don’t have sales tax audit experience, how can you trust that the state's auditor abides by the rules and follows proper procedures?

How will you know when to provide documents or when to push back?

Do you thoroughly understand your sales and use tax areas of exposure?

Controlling the audit is paramount to limiting exposure and shaping the results. Are you confident in doing that on your own?

Unless you can confidently answer these questions, hiring a professional is most likely to be the best option.

Contact us to learn how our sales tax professionals can give you the peace of mind and confidence you’ll need during your audit.

Visit our resource pages for more information to help you make critical decisions during your Vermont sales and use tax audit.

- The Audit Overview & Selection Process

- The General Audit Process

- Statute of Limitations Extensions & Issues

- Managing the Sales Tax Auditor

What to Expect from a Vermont Sales Tax Auditor

Here is a summary of the general audit process:

The auditor will conduct pre-audit research.

The auditor will often schedule and perform an entrance conference.

The auditor will request records (many of which the auditor is not entitled to and does not need).

Once the auditor receives the necessary records, they will compare your Vermont Sales and use tax returns to your federal income tax returns or bank statements to determine whether you reported all applicable or gross sales on your Vermont Sales tax return(s).

NOTE: A slight error in how the tax was charged on even a single type of transaction can add up to a significant sales tax liability.

Once the auditor is confident all sales are accounted for, they will:

Review your exempt and out-of-state sales.

Conduct a use tax audit – the auditor will request accounts documents to ensure you adequately paid use tax on applicable purchases.

Common areas audited include:

- Advertising Expense

- Auto & Truck Expense

- Repair and Maintenance

- Office Expense

- Miscellaneous Expense

- Supplies

- Equipment

After reviewing all information, the auditor will prepare a proposed audit report which shows preliminary findings, and a preliminary amount due or refund. The proposed audit report is the basis for discussion between you and the auditor; it is not a final determination. It may be estimated in cases where requested information has not been provided.

If a business buys an item online without paying use tax, the business is still obligated to remit the tax to West Vermont. Believing otherwise often leads to shocking results for the unsuspecting taxpayer during an audit. Here is more information on Vermont Use Tax.

If you have questions about your situation, contact us to discuss it with one of our tax professionals.

After the Audit – Understand and Defend Your Businesses Rights

The auditor will produce an audit report with corresponding work papers to support the Vermont sales and use tax assessment.

It is advisable to have a sales tax professional present during this meeting. This is your first opportunity to see the auditor's findings. You'll want to push back on areas where they have overstepped their bounds or misapplied West Vermont's sales tax laws.

It's best to hold off on agreeing to the sales tax assessment until a sales tax professional has reviewed it for issues that should be challenged.

| Many businesses wind up drastically overpaying the state because the business owner or in-house accounting personnel weren't well versed in the sales tax laws that, if challenged, could have reduced their sales tax liability. |

In the following sections, we'll cover the process of challenging a Vermont sales tax audit assessment.

Contesting Audit Assessment After the Audit – The Appeal

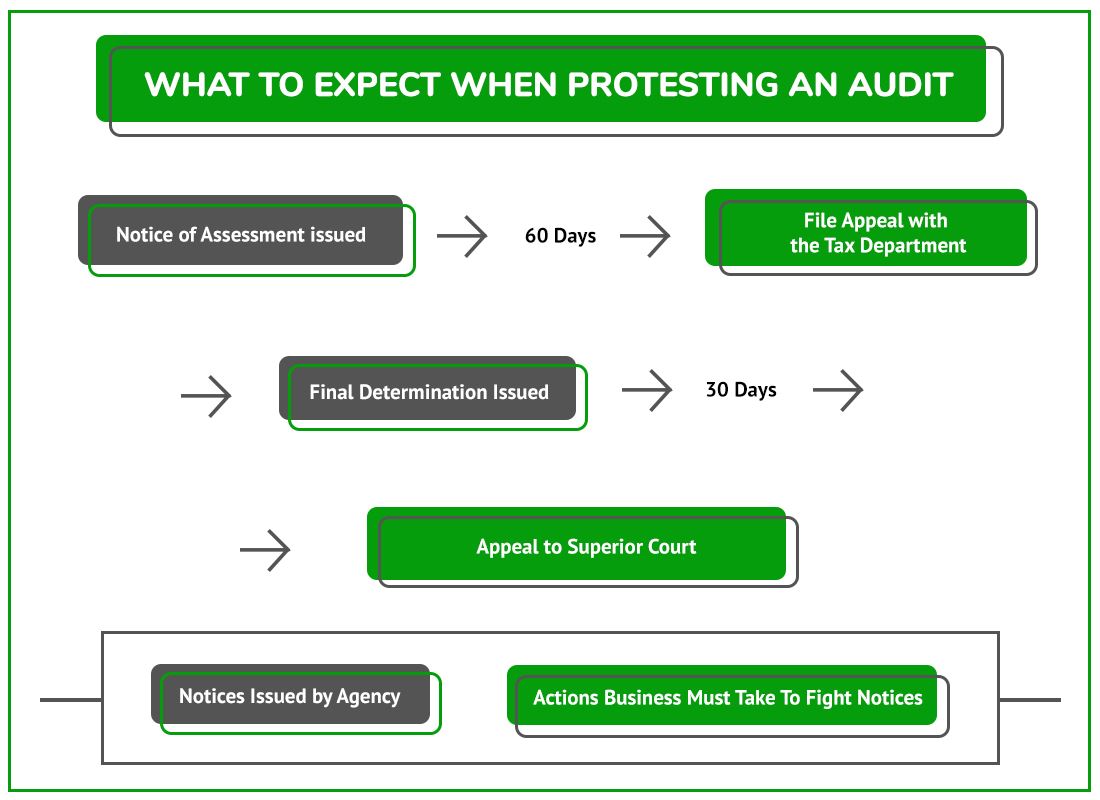

Vermont Sales Tax Audit Protest Process Flow Chart

NOTE: If the deadlines are missed, it is implausible that you will be able to have the case reopened.

You will receive a Notice of Assessment or audit report from the Tax Commissioner. It's essential to review and understand its implications carefully.

The audit report:

- Details of the auditor's findings

- Describes any proposed audit adjustments

- Shows the amount of tax, interest, and penalty due

If you disagree with the assessment, you may request an informal conference with the auditor.

If you and the auditor cannot agree, the Department will issue a final notice of field audit determination. It is final unless you appeal it.

Audit Closing Conference

The taxpayer has a short period to contest the findings with the auditor. Any issues with the results are handled as follows:

- Issues related to exemptions, proof of tax paid, and calculations are worth addressing with the auditor.

- Legal interpretations of sales tax law are often not resolvable at this stage.

If you cannot resolve this with the auditor, the next step is to appeal/protest the issue.

Appeal/Protest with The Vermont Tax Commissioner

Protest Rights and Audit Finding Confirmation

You have the right to file an appeal directly with the Tax Commissioner if you believe the assessment is incorrect. You must file a complete appeal within 60 days of the assessment date. This 60-day limitation period is strictly enforced.

The appeal will result in a hearing or conference at the Department of Taxes. While the rules of evidence are relaxed, the Department representatives will have an opportunity to argue their legal position. They will have a representative present at the hearing, calling witnesses and presenting evidence just like the taxpayer. For this reason, it is highly advisable to have a sales tax lawyer, accountant, or professional on your side to better present your case and the interests of the business.

Vermont does not have an administrative or tax court appeal, so the appeal is your shot to resolve your case. Unfortunately, the judge, who will issue a final decision with factual findings and legal conclusions, is also a hearing officer who happens to be an employee of the Department of Taxation. In Vermont, the Department of Taxation acts as judge, jury, and executioner.

Final Decision

The Tax Department will issue a determination letter in response to the taxpayer's administrative appeal. The determination will be based on the issues raised in the administrative appeal.

If you have received a Certificate of Assessment and haven't talked to someone experienced in Vermont State tax, now is the time. Do it before these deadlines pass.

Settling a Vermont Sales Tax Liability

After any critical notices are issued, settling your Vermont Sales tax case with the Vermont Department of Taxes is possible by filing a Vermont Offer in Compromise. The business must meet specific criteria to qualify, but you can get better results negotiating here than with the auditor. However, knowing a fair settlement from an unreasonable settlement will be challenging without experience and knowledge of Vermont Tax laws.

DO NOT attempt to negotiate a settlement without an experienced Vermont State and local tax lawyer or other professional.

Contest a Vermont Jeopardy Assessment

Vermont may issue a Notice of Jeopardy Determination in certain situations.

The jeopardy assessment gives the Vermont Department of Taxes the right to try to collect immediately.

Due to the jeopardy nature, the taxpayer only has a very short time to contest the assessment and must place a security deposit to fight the issue.

Appeal to the Superior Court

If you cannot resolve your case with the Tax Department, you still have a chance to fight your Vermont sales tax assessment in the Superior Court. You can appeal the decision to the Superior Court within 30 days of the date of the final decision by the Tax Department.

Because there is no administrative or tax court equivalent in Vermont, it is often advisable to take the appeal to judicial court, even as we can consider the hazards of litigation. A request to the Superior Court is the last, and sometimes the best, chance to get a reasonable and viable settlement on your case.

Our team has handled hundreds of administrative court cases. It can help your company receive the resolution you are entitled to. Get in touch with us today.

Other Vermont Sales Tax Resources

Reviews

-

"Take Control of your sales tax with easy-to-use DIY tools. Get the guidance you need - without the high cost of full-service support."

Meet David, the Auto Repair Shop Owner (DIY)

- The DIY Business Owner -

"Get expert answers when you need them. Our on-demand consulting service connects you with tax professionals for quick, reliable advice—without long-term commitments."

Meet Mark, the Business Owner Who Needs Quick Answers

- The On-Demand Consultant User -

"Outsource your sales tax headaches to proven experts. Our full-service solutions handle compliance, audits, and dispute resolution—so you can focus on growing your business."

Meet Greg, the CFO of a Multi-State Manufacturing Company

- The Managed/Enterprise CFO -

"Stay in control while getting expert help when you need it. Our guided sales tax solutions give you access to professionals for compliance, audits, and appeals—without the cost of full-service management."

Meet Kris, the Multi-Store Gas Station & Convenience Operator: Multi-Location Owner (Guided Support)

- The Guided Business Owner -

"Jerry is the best!"

Jerry is the best! I made the mistake thinking I could deal with the use tax auditor on my own not realizing that I would be ...

- Gary O. -

"Sales Tax Helper Can Make Miracles Happen"

Sales Tax Helper can make miracles happen. Jerry was able to wipe hundreds of thousands of dollars off a NY sales tax bill ...

- Zalmi D. -

"I Will Definitely Be Using His Services Again"

Jerry was very helpful and listened to all our concerns. I will definitely be using his services again.

- Joyce J. -

"Representing Our Company Professionally"

Owning a Texas car dealership is demanding work, so taking on a Texas Sales Tax Audit was a daunting task for us – we didn’t ...

- Ata A.