Connecticut Sales Tax & Audit Guide

Straightforward Answers to Your Connecticut Sales Tax Questions.

- Do I need to collect Connecticut sales tax?

- Should I be collecting or paying Connecticut use tax?

- What do I do if I should have been collecting but haven't?

- I received an audit notice. What should I do?

- Guidance on fighting a sales tax assessment in Connecticut.

Who Needs to Collect Connecticut Sales and Use Tax?

Like most states, to be subject to Connecticut sales tax collection and its rules, your business must:

1) Have nexus with Connecticut, and

2) Sell or use something subject to Connecticut sales tax.

How is Nexus Established in Connecticut?

According to the Connecticut Department of Revenue, anyone engaged in business in Connecticut must register with the Department of Revenue Services for a Sales and Use Tax Permit if they are:

1. Selling tangible personal property for storage, use, or other consumption in the state

2. Selling taxable services in the state

Additionally, businesses that do not have a physical presence in Connecticut can establish economic nexus by exceeding a certain annual sales threshold in Connecticut. See the next section for details.

Economic Nexus (Wayfair Law) and Internet Sales in Connecticut Out-of-state sellers have established economic nexus and must register with the Department of Revenue to secure a Connecticut Sales and Use Tax Permit, if:

- The seller conducts retail sales of tangible personal property or services to a destination in Connecticut

and

- Over the 12-month period ending on the September 30th immediately preceding the monthly or quarterly period that tax liability is determined, make:

- 200 or more retail sales in Connecticut, and

- a minimum of $100,000 in gross sales receipts in Connecticut.

Out-of-state sellers who repair or service goods sold by them in Connecticut, directly or through an agent, independent contractor, or subsidiary, must also register with DRS and obtain a Sales and Use Tax Permit.

How is the $100,000 gross revenue threshold calculated?

To calculate the $100,000 gross revenue threshold, include all sales of tangible personal property and taxable services delivered into Connecticut, including non-taxable retail sales of tangible personal property. Include the total gross receipts from all sales of tangible personal property in Connecticut, even if no sales were made or no tax is due. Both taxable and nontaxable sales must be reported.

Marketplace Facilitators and Sellers

Marketplace facilitators must register with the Department of Revenue to secure a Sales and Use Tax Permit. A marketplace facilitator is any entity that:

- During the preceding twelve-month period, facilitated retail sales of at least $250,000 by marketplace sellers by providing a forum to list or advertise tangible personal property that is subject to sales and use taxes, including digital goods or taxable services.

- Collects receipts from customers and remits payments to the marketplace sellers

- Either directly or indirectly, or through agreements with third parties; and

- Receives compensation or other consideration for provided services.

Marketplace Sellers

Suppose your business sells through Amazon or a similar marketplace facilitator. In that case, you may not have to collect sales and use tax on those sales. Specifically, if the marketplace facilitator certifies that they collect and report sales tax on your sales, you are off the hook. However, such sales may still count towards your total sales threshold, meaning you’ll still need to collect tax on sales made directly through your website or any other marketplaces that don’t collect sales tax on your behalf.

Here is some additional information for marketplace facilitators and sellers: Connecticut Sales and Use Tax of Drop Shipments

Which Sales are Subject to Connecticut Sales Tax?

General Transactions

If you have nexus in Connecticut, the next step is to determine whether the products or services you sell are subject to Connecticut sales and use tax.

Unless an item is specifically exempt, sales and rentals of tangible personal property are subject to Connecticut sales tax.

The rules seem simple, but many details make applying Connecticut’s tax rules to your business challenging.

We recommend scheduling a time to review your specific situation with one of our sales tax professionals.

Common Exemptions from Connecticut Sales and Use Tax:

Exempt items include:

- Bicycle Helmets

- Booster seats and child car seats for use in motor vehicles are exempt. However, products that combine car seats and strollers into which child car seats may be placed and that are priced as one item are not exempt.

- Sales of college textbooks to full-time and part-time students. College textbooks are new or used books and workbooks required or recommended for courses. More info here: SN 2000(9), Sales and Use Tax Exemption for College Textbooks;

- Current United States and Connecticut flags

- Firearm (gun) safety devices

- Food products for human consumption

- Food products sold through coin-operated vending machines, meals delivered to the elderly, disabled or homebound, and purchases made with supplemental nutrition assistance program benefits are exempt from tax.

- For information on the taxability of meals, see: PS 2002(2), Sales and Use Taxes on Meals.

- Vegetable seeds are suitable for planting to produce food for human consumption.

- Internet Access Services

- Magazines sold by subscription, and newspapers

- Medical goods and equipment, for example:

- Mobility devices such as crutches, walkers, canes, wheelchairs, and inclined stairway chairlifts for disabled persons, and repair or replacement parts and repair services to these devices.

- Nonprescription drugs and medicines.

- Prescription eyewear and nonprescription reading glasses

- Certain motor vehicles, aircraft, and vessels under certain conditions

- Personal property used in burial or cremation with a value up to $2,500 for any single funeral. and caskets for burial

- Rare or antique coins

- Shoe repair services

- Certain services provided at the residence of a disabled person eligible for and currently receiving total disability benefits under the Social Security Act.

- Environmental consulting or other services rendered in connection with aircraft leased or owned by a certificated air carrier or an aircraft with a maximum certificated take-off weight of six thousand pounds or more.

- Training Services when the service is provided by an institution licensed or accredited by the CT Board of Governors of Higher Education.

Services

The Connecticut Sales and Use Tax Act imposes a tax on the receipts from every retail sale of tangible personal property, specified digital products, and the sale of certain services, except where specifically exempted. Here’s more information on the taxable status of specific services in Connecticut:

- Advertising and Public Relations Services

- Graphic Designers

- Management, management consulting, business analysis, and public relations services

- Dry Cleaning and laundry services

- Employment agencies and agencies providing personnel services

- Exterminating services

- Flight instruction and chartering by a certificated air carrier

- Furniture reupholstering and repair services

- Athletic and health club services, including yoga instruction provided at a yoga studio

- Lobbying or consulting services

- Miscellaneous personal services except services rendered by licensed massage therapists and licensed hypertrichologists

- Motor vehicle repairs

- Parking services, including valet parking at airports

- Personnel training services

- Photographic studio services

- Piped-in music provided to business

- Prepaid Telephone Calling Services

- Watchman and armored car services, private investigation, protection, patrol work, excluding these services provided by off-duty police officers and firefighters

- Radio or television repair services

- Refuse removal for income-producing property

- Renovation and repair services to income-producing property

- Repair or maintenance services to tangible personal property and contracts of maintenance, repair, or warranty

- Sales agent services for the selling of tangible personal property

- Stenographic services

- Storage: The provision of space for storage of personal property by a person in the business of providing storage space, excluding space used for residential purposes

- Telephone answering services

- Window cleaning services

- Janitorial service (including the cleaning of homes, offices, and commercial property)

- Contractor services

- Landscaping and horticulture services

- Locksmith services

- Maintenance services to real property

- Warranty or service contracts for any item of tangible personal property.

- Swimming pool cleaning and maintenance services

- Services to income-producing real property

- Repair services to electrical or electronic devices

- Painting and lettering services

You can find additional information here.

Software

Computer and Data Processing Services

Computer and data processing services are taxed at 1%, even where such services are provided in connection with the development, creation, or production of canned or custom software or the license of custom software, and services in connection with the design, development, hosting or maintenance of all or part of a web site.

Computer and data processing services include charges for:

- online access to computer services,

- providing computer time,

- providing consulting services, and conducting feasibility studies,

- retrieving or providing access to information,

- storing and filing of information,

- designing, implementing, or converting systems,

- installation and implementation of software programs and systems

- programming, code writing, modification of existing programs

Software as a Service (Saas) and Custom Software

Because the sale of custom software is the sale of computer services, it is subject to tax at the 1% rate.

Prewritten software

When a retailer provides tangible personal property to a purchaser, charges for the sale, lease, rental, licensing, or upgrading of prewritten software are subject to tax.

- Software may qualify for a full or partial exemption when it is purchased as:

- a part of qualifying machinery and equipment or

- as computer services related to qualifying machinery and equipment

- Both full and partial manufacturing exemptions apply to tangible personal property only.

- Services purchased as a separate transaction from the sale of tangible personal property are not eligible for any of the manufacturing exemptions.

Canned Software

When canned software is delivered electronically, and the retailer provides no tangible personal property to the purchaser, charges for the sale, lease, rental, licensing, or upgrading of canned software are taxable at the 1% rate as computer and data processing services.

- Canned or prewritten software means all software other than custom software, held or existing for general or repeated sale, license, or lease.

- Software initially developed as custom software for in-house use, but then subsequently sold, licensed, or leased to unrelated third parties is canned or prewritten software.

See page 41 of the Sales and Use Taxes Guide for Manufacturers, Fabricators, and Processors for more details, including exemption information.

Shipping & Handling

Suppose the goods being shipped by the seller are taxable. In that case, the shipping and delivery charges are also subject to tax regardless of whether the charges are separately stated or whether the shipping or delivery is provided by the seller or by a third party. See also: Shipping and Handling FAQ.

In instances where taxable and non-taxable goods are part of the same shipment, the seller may calculate a portion of the shipping charge equal to the portion of the taxable items in the shipment.

To calculate the portion of the charge subject to tax, the purchaser may prorate the amount using the same measure (for example, weight or sales price) used to determine the shipping charge. See the example below:

Example

A seller charges a delivery fee of $30 the shipment of $200 of taxable and non-taxable merchandise ($.15 per dollar value of merchandise). The cost of the taxable merchandise is $120. The portion of the freight charge attributed to the delivery of the taxable merchandise is $18 ($120 x $.15). Therefore, only $18 of the $30 delivery fee is subject to tax.

Industry-Specific Guidance

While the general sales tax rules seem straightforward, applying those rules can get tricky when gray areas come up. The Connecticut Department of Revenue provides some specific guidance for the following:

- Sales and Use Taxes Guide for Manufacturers, Fabricators, and Processors

- Building Contractors' Guide to Sales and Use Taxes

- Sales and Use Taxes on Access to the Internet and Other Online Sales of Goods and Services

- Sales and Use Taxes on Computer-Related Services and Sales of Tangible Personal Property

- 2015 Legislative Changes to the Sales and Use Taxes, Rental Surcharge, Dry Cleaning Surcharge, and Admissions Tax

- Automatic Data Processing Services and Equipment

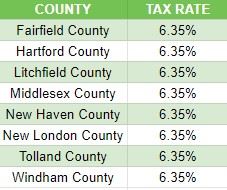

Determining Local Sales Tax Rates in Connecticut

Connecticut’s statewide sales tax rate is 6.35%. Local jurisdictions impose no additional sales taxes in Connecticut.

Local Sales and Use Tax Tables

Local jurisdictions do not impose additional sales taxes in Connecticut.

The statewide rate of 6.35% applies to the retail sale, lease, or rental of most goods and services, with the following exceptions:

TAX RATE | ITEM OR SERVICE | ITEM OR SERVICE |

9.35% | rental or leasing of a motor vehicle for a period of 30 consecutive calendar days or less | |

7.75% | over $50,000 sale of most motor vehicles, more than $5,000 of jewelry (whether real or imitation), more than $1,000 of an article of clothing or footwear to be worn on or about the human body, including accessories such as a handbag, luggage, umbrella, wallet, or watch. | |

1% | the sale of data processing and computer services. For more information please review: Policy Statement 2006(8), Sales and Use Taxes on Computer-Related Services and Sales of Tangible Personal Property. | |

4.5% | the sale of a vehicle to a nonresident member, or a member and their spouse jointly, of the armed forces of the United States stationed on full-time active duty in Connecticut. For more information, see Policy Statement 2001(4), Sales of Motor Vehicles to Nonresident Military Personnel and Joint Sales of Motor Vehicles to Nonresident Military Personnel and Their Spouses. | |

2.99% | the sale of vessels, motors for containers, and trailers used for transporting a vessel. See Special Notice 2018(5.1), Legislative Changes Affecting Motor Vehicle Fuels Tax, Sales and Use Taxes and Rental Surcharge. | |

7.35% | on sales of meals and certain drinks. For additional information about taxable meals, see: Policy Statement 2002(2), Sales and Use Tax on Meals. |

*Exact tax rates vary. Occupancy fees and taxes are not included in this table.

I Should Have Collected Connecticut Sales Tax, But I Didn't

Many of our competitors will suggest Filing a Voluntary Disclosure Agreement in each state. This is a one-size-fits-all solution that isn't always the best. Our sales tax professionals will work with you to determine the best and most cost-effective solution for your business.

If you determine your business has nexus, but you have not collected Connecticut sales tax, here are your options:

1. Register and pay back taxes, penalties, and interest, or

2. Complete a VDA to cut penalties (and, in some cases, reduce your tax liability and avoid interest).

Here is what you need to know about each option to make the best decision for your business:

Option 1: Register to Pay Back Taxes, Penalties, and Interest.

A VDA is not cost-effective if the past liabilities and penalties are minimal. Sometimes the best resolution for a business is to register with Connecticut and pay back taxes, penalties, and interest.

Be wary of the tax professionals that recommend doing a VDA in these cases. They are looking to make a buck rather than looking out for your best interests.

When to consider registration and payment:

- If you established nexus less than 3 or 4 years ago.

- The sales tax penalty is LESS than the professional fees charged for the VDA.

- Your business does NOT have a sales tax collected issue.

Beware: Registering does not generally end past liabilities.

If you're unsure what your past liabilities are, contact us. Our state tax professionals work with you so you can make the right choice for your business.

Option 2: Voluntary Disclosure Agreement (VDA)

Connecticut's lookback period: The standard lookback period is three years.

In many situations, voluntary disclosures are a valuable tool to reduce extended periods of past exposure.

The voluntary disclosure limits the lookback period to three years. Suppose you should have collected sales tax over the past ten years but didn't. If that is the case, you may benefit from doing a VDA.

A VDA may be a good option for you if:

- You established nexus more than 3 or 4 years ago.

- You have a sales tax collected but not remitted issue.

- The sales tax penalty savings is MORE than the professional fees charged for the VDA.

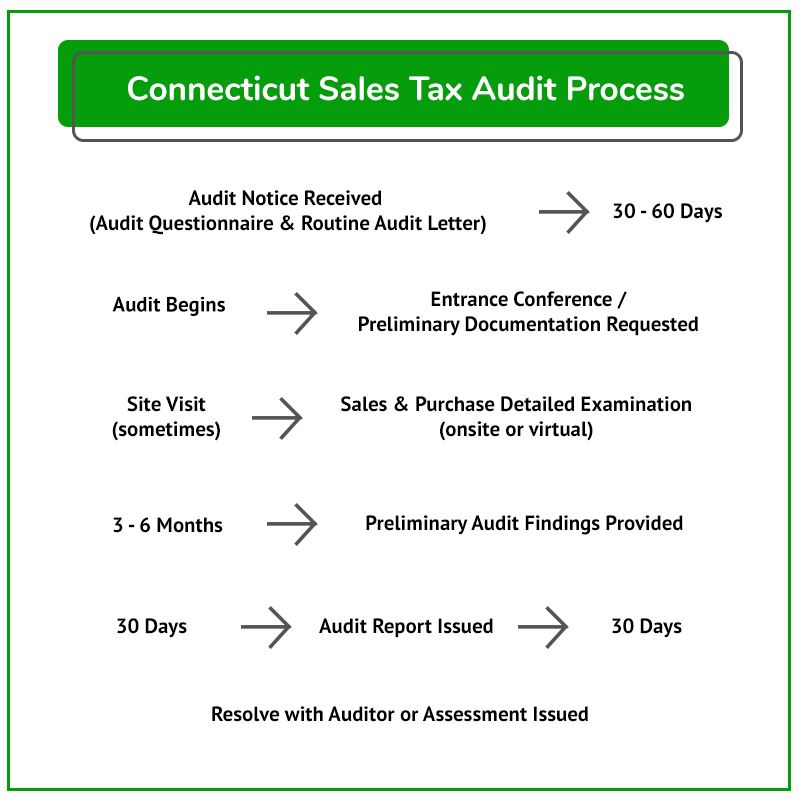

What to Expect During an Audit

The typical audit process is shown in this flowchart. Detailed guidance for each stage of the process follows in the sections below.

Connecticut regularly audits businesses required to charge, collect, and remit various taxes in the state.

Many audits begin with a call from the Connecticut Department of Revenue's sales tax auditor.

Shortly after the call, your business will receive a Notification of Intent to Audit. This notification confirms that you were lucky enough to be chosen for a Connecticut sales tax audit.

It is good to start with getting a state and local tax professional involved to prepare for the audit.

I Received a Connecticut Sales Tax Audit Notice. What Should I Do?

Businesses that receive a sales tax audit notice need to consider the following questions:

- If you don’t have sales tax audit experience, how can you trust that the state's auditor abides by the rules and follows proper procedures?

- How will you know when to provide documents or when to push back?

- Do you have a thorough understanding of your sales and use tax areas of exposure?

- Controlling the audit is paramount to limiting exposure and shaping the results. Are you confident in doing that on your own?

Unless you can confidently answer these questions, hiring a professional is most likely to be the best option. Contact us to learn how our sales tax professionals can give you the peace of mind and confidence you’ll need during your audit.

Visit our resource pages for more information to help you make critical decisions during your Connecticut sales and use tax audit.

- The Audit Overview & Selection Process

- The General Audit Process

- Statute of Limitations Extensions & Issues

- Managing the Sales Tax Auditor

What to Expect from a Connecticut Sales Tax Auditor

In addition to the standard audit procedures outlined below, Connecticut has also enacted a policy regarding retail transactions where an audit finds a retailer hadn't collected sales tax from another retailer currently being audited. If you are doing business in Connecticut, it may be worth reviewing. PS 2013(1), Audit Examination Policy for Retail Transactions

It's quite a lengthy read. If you have questions about your situation, contact us to discuss it with one of our tax professionals.

For now, here is the summary of the general audit process:

- The auditor will conduct pre-audit research.

- The auditor will often schedule and perform an entrance conference.

- The auditor will request records (many of which the auditor is not entitled to and does not need)

Once the auditor receives the necessary records, they will compare your Connecticut sales and use tax returns to your federal income tax returns or bank statements to determine whether you reported all applicable or gross sales on your Connecticut sales tax return(s).

NOTE: A slight error in how the tax was charged on even a single type of transaction can add up to a significant sales tax liability.

Once the auditor is confident all sales are accounted for, they will:

- Review your exempt and out-of-state sales.

- Conduct a use tax audit – the auditor will request documents of accounts to make sure use tax was paid adequately on applicable purchases.

Common areas audited include:

- Advertising Expense

- Auto & Truck Expense

- Repair and Maintenance

- Office Expense

- Miscellaneous Expense

- Supplies

- Equipment

If a business buys an item online without paying sales tax, the business may still be obligated to remit use tax to Connecticut. Believing otherwise often leads to shocking results for the unsuspecting taxpayer during an audit. Here is more information on Connecticut Use Tax. |

After the Audit – Understand and Defend Your Businesses Rights

Upon completion of the audit, there will usually be an exit conference with the auditor. The auditor will produce an audit report with corresponding work papers to support the Connecticut sales and use tax assessment.

It is advisable to have a sales tax professional present during this meeting. This is your first opportunity to see the auditor's findings. You'll want to push back on areas where they have overstepped their bounds or misapplied Connecticut's sales tax laws.

It's best to hold off on agreeing to the sales tax assessment until a sales tax professional has reviewed it for issues that should be challenged.

| Many businesses wind up drastically overpaying the state because the business owner or in-house accounting personnel weren't well versed in the sales tax laws that, if challenged, could have reduced their sales tax liability. |

We'll cover the process of challenging a Connecticut sales tax audit assessment in detail in the following sections.

Contesting Audit Findings with the Auditor

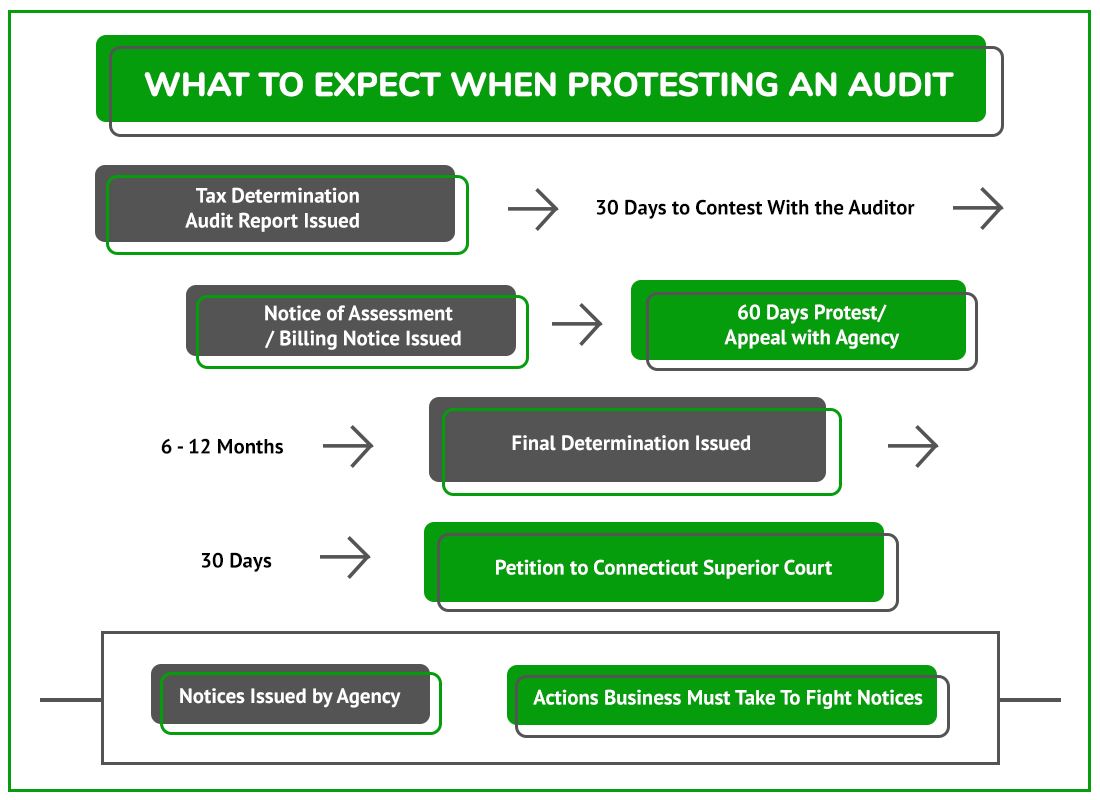

Connecticut Sales Tax Audit Protest Process Flow Chart

NOTE: If the deadlines are missed, it can be tough to get the case reopened.

After an audit, the auditor will issue a Tax Determination Report (AKA the audit report). It's essential to review and understand its implications carefully.

The audit report:

- Details of the auditor's findings

- Describes any proposed audit adjustments

- Shows the amount of tax, interest, and penalty due

If you disagree with the proposed changes, you may request an informal conference with the auditor. You must request an informal conference and attempt to resolve the case with the auditor.

Audit Closing Conference

The taxpayer has a short period to contest the findings with the auditor. Any issues with the results are handled as follows:

1. Issues related to exemptions, proof of tax paid, and calculations are worth addressing with the auditor.

2. Legal interpretations of sales tax law are often not resolvable at this stage.

Adjustments to the audit assessment will be made where necessary after this conference, and notice of assessment will be issued.

If you cannot resolve this with the auditor, the next step is to appeal/protest the issue with the Connecticut Department of Revenue Appellate Division.

Appeal/Protest with The Connecticut Department of Revenue

Protest Rights and Audit Finding Confirmation

- If you disagree with an audit's findings, you have 60 days from the first formal billing / Notice of Assessment date to file an appeal.

- The appeal must state why the assessment, the tax, interest, or penalties are incorrect.

- You must complete a protest/appeal within 60 days, sixty (60) days from the date of the first formal billing notice.

If you have received a Notice of Assessment and haven't talked to someone experienced in Connecticut State tax, now is the time. Do it before these deadlines are missed.

Final Decision

The Connecticut Department of Revenue Appellate Division will issue a Final Determination.

If the assessment is not settled to your satisfaction by the Department of Revenue Appellate Division, you may take your case to the superior court within one month of receiving the Final Determination Letter.

Settling a Connecticut Sales Tax Liability

After any critical notices are issued, it's possible to settle your Connecticut sales tax case with the Connecticut Department of Revenue by filing a Connecticut Offer in Compromise. However, to qualify, the business must meet specific criteria, as explained by the Department. Often, you can get better results negotiating here than with the auditor.

Without experience and knowledge of Connecticut tax laws, knowing a fair settlement from an unreasonable one will be challenging.

DO NOT attempt to negotiate a settlement without an experienced Connecticut state and local tax lawyer or other professional.

Contest a Connecticut Jeopardy Assessment

Connecticut may issue a Notice of Jeopardy Determination in certain situations.

The jeopardy assessment gives the Connecticut Department of Revenue the right to try to collect immediately.

Due to the jeopardy nature, the taxpayer only has a very short time to contest the assessment and must place a security deposit to fight the issue.

Connecticut Superior Court

Suppose you can't resolve the case within the agency. There's still one chance to fight your Connecticut sales tax assessment: Superior / Judicial Court. Unlike many states, Connecticut does not have a tax / administrative court appeal option. Although the Court has a Tax and Administrative Appeals section, this is court and operates as such. Therefore, it is imperative to have a tax professional well versed in state tax on your team for this stage, if you have not already done so.

We don't generally recommend it, but you always have the option to skip the agency protest process and file it in tax court. Neither party wants to spend the time and resources on the uncertainty of the tax court. So, challenging the assessment can effectively maximize your settlement potential, provided you have an experienced representative.

Our team has handled hundreds of administrative court cases. It can help your company receive the resolution you are entitled to. Get in touch with us today.

Other Connecticut Sales Tax Resources

Connecticut Department of Revenue Sales Tax Website

Connecticut Regulations – Title 12- Taxation

Connecticut Taxpayer Special Bulletins

Reviews

-

"Take Control of your sales tax with easy-to-use DIY tools. Get the guidance you need - without the high cost of full-service support."

Meet David, the Auto Repair Shop Owner (DIY)

- The DIY Business Owner -

"Get expert answers when you need them. Our on-demand consulting service connects you with tax professionals for quick, reliable advice—without long-term commitments."

Meet Mark, the Business Owner Who Needs Quick Answers

- The On-Demand Consultant User -

"Outsource your sales tax headaches to proven experts. Our full-service solutions handle compliance, audits, and dispute resolution—so you can focus on growing your business."

Meet Greg, the CFO of a Multi-State Manufacturing Company

- The Managed/Enterprise CFO -

"Stay in control while getting expert help when you need it. Our guided sales tax solutions give you access to professionals for compliance, audits, and appeals—without the cost of full-service management."

Meet Kris, the Multi-Store Gas Station & Convenience Operator: Multi-Location Owner (Guided Support)

- The Guided Business Owner -

"Jerry is the best!"

Jerry is the best! I made the mistake thinking I could deal with the use tax auditor on my own not realizing that I would be ...

- Gary O. -

"Sales Tax Helper Can Make Miracles Happen"

Sales Tax Helper can make miracles happen. Jerry was able to wipe hundreds of thousands of dollars off a NY sales tax bill ...

- Zalmi D. -

"I Will Definitely Be Using His Services Again"

Jerry was very helpful and listened to all our concerns. I will definitely be using his services again.

- Joyce J. -

"Representing Our Company Professionally"

Owning a Texas car dealership is demanding work, so taking on a Texas Sales Tax Audit was a daunting task for us – we didn’t ...

- Ata A.