Arizona Sales Tax & Audit Guide

Straightforward Answers to your Arizona Transaction Privilege Tax (Sales Tax) Questions

- What is Arizona's Transaction Privilege Tax (TPT)?

- Do I need to collect Arizona sales tax?

- Should I be collecting or paying Arizona use tax?

- What do I do if I should have been collecting but haven't?

- I received an audit notice. What should I do?

- Guidance on fighting a sales tax assessment in Arizona.

What is Arizona's Transaction Privilege Tax (TPT)?

Technically, Arizona doesn't have a sales tax. Instead, it has a transaction privilege tax (TPT). While related, the TPT differs from a true sales tax because it's a tax on the privilege of conducting business in Arizona. A sales tax, in comparison, is a consumption tax on the sale of goods and services. The business can pass the cost of the tax burden on to the customer at the time of sale.

Who Needs to Collect Arizona Sales and Use Tax?

The TPT is the responsibility of vendors who have nexus in Arizona and make qualifying transactions. Likewise, individual consumers can also be responsible for TPT on the personal property they use or store in Arizona from a vendor not obligated to report to the Arizona Department of Revenue (ADOR).

How Does Arizona Establish Nexus for Businesses?

The following business activities could establish your nexus with the state of Arizona for the purpose of remitting TPT to the ADOR:

1. Having a physical location in Arizona including an office building, a warehouse, or another facility.

2. Having agents in the state who carry out business activities like making sales, deliveries, etc.

3. Providing taxable services on property such as assembly, installation, or repair work.

4. Owning or leasing property in Arizona, including a computer server or software to solicit orders for taxable items.

6. Using a third-party fulfillment service to maintain inventory in Arizona, such as Fulfilled by Amazon ("FBA").

7. Meeting the sales threshold for having economic nexus in Arizona as an online retailer.

Economic Nexus (Wayfair Law) and Internet Sales in Arizona

In 2019, Arizona introduced a new dollar-based standard for businesses with no physical presence in the state. This is known as economic nexus. The annual sale threshold for nexus is as follows for recent tax years:

- $200,000 for 2019

- $150,000 for 2020

- $100,000 for 2021 and beyond

Currently, if you make sales in Arizona through a website you own, you must collect and remit sales tax to Arizona once your sales reach $100,000. You have 30 days from when you hit this threshold to get a license and start collecting and remitting sales tax.

Remote Sellers That Use Marketplace Facilitators

Marketplace facilitators are online platforms like Etsy or Amazon that sell and deliver your goods on your behalf.

Online retailers who only use a marketplace facilitator for sales in Arizona do not generally need a license with Arizona to file and remit TPT. The marketplace facilitator you sell through should maintain this responsibility for you. You still need to keep records of those sales for other reporting obligations you may have. You should also obtain a Remote Seller Exemption Certificatefrom each marketplace facilitator that you use.

Here are some additional Arizona TPT resources for marketplace facilitators and remote sellers:

Which Sales are Subject to Arizona Sales Tax?

General Transactions

Unless an item is specifically exempt, the sale or lease of tangible personal property (as well as related services) are subject to Arizona sales tax under the retail classification. This rule sounds straightforward, but nuances and vagueness in Arizona’s TPT can make it difficult to apply to your transactions.

Schedule a time to review your specific situation with one of our sales tax professionals.

Common Exemptions from Arizona Sales and Use Tax:

- Certain Sales to State and Federal Government

- Sales by a non-profit organization.

- Business activities performed on a reservation are tax exempt. See Tax exemption; sales to Indian tribes, tribally owned businesses, tribal entities, and affiliated Indians for more information.

- Sales of Groceries are exempt from the sales tax in Arizona. However, catering sales are taxable. See Tax exemptions related to food for more details

- Lottery tickets

- Textbooks, sold by a bookstore, that are required by any state university or community college.

- Magazines, periodicals, and other publications produced by this state to encourage tourist travel.

- Paper machine clothing, such as forming fabrics and dryer felts, purchased by a paper manufacturer, and directly used or consumed in paper manufacturing.

Software

Pursuant to numerous letter rulings, Arizona treats the sale of software as tangible personal property and, thus, subject to TPT. Likewise, the sales of SaaS and cloud computing are broadly taxable in Arizona as well. But custom software designed for the use of only one company or person is exempt from TPT. Computer hardware is considered a retail sale and is taxed.

Shipping & Handling

Arizona has somewhat technical rules on the taxability of shipping and delivery charges. Under Arizona’s regulations, a charge by the retailer for shipping and delivery charges are not taxable when separately stated on the invoice. However, charges more than the actual delivery cost may be taxable.

Industry Specific Transaction Privilege Classifications

Article 2 of Arizona’s Revised Statutes maintains the following classification schedules to help business owners understand when their transactions are or are not subject to TPT:

- 42-5061 Retail classification; definitions

- 42-5061; Version 2 Retail classification; definitions

- 42-5062 Transporting classification

- 42-5063 Utilities classification; definitions

- 42-5064 Telecommunications classification; definitions

- 42-5065 Publication classification; definition

- 42-5066 Job printing classification

- 42-5067 Pipeline classification

- 42-5068 Private car line classification

- 42-5069 Commercial lease classification; definitions

- 42-5070 Transient lodging classification; definition

- 42-5071 Personal property rental classification; definitions

- 42-5072 Mining classification; definition

- 42-5072; Version 2 Mining classification; definition

- 42-5073 Amusement classification

- 42-5074 Restaurant classification

- 42-5075 Prime contracting classification; exemptions; definitions

- 42-5076 Online lodging marketplace

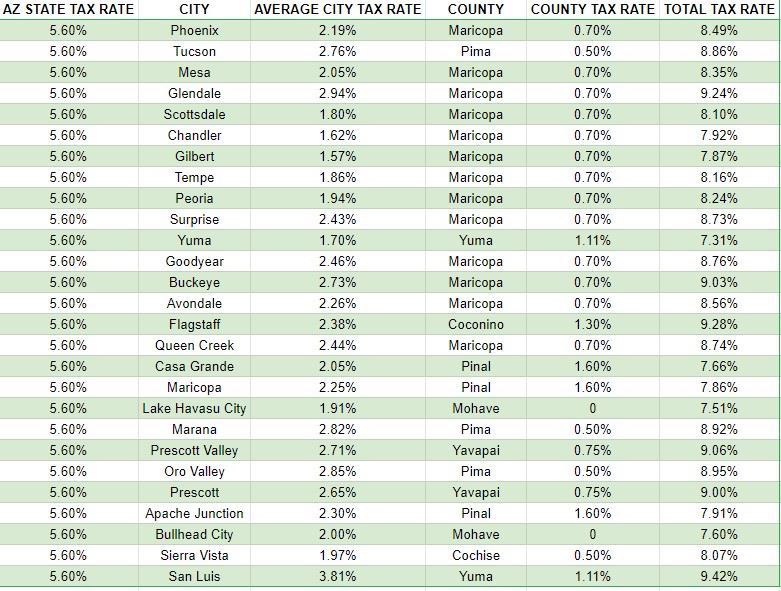

Determining Local Sales Tax Rates in Arizona

Arizona's base rate for TPT is 5.6%. However, cities, counties, special purpose districts, and transit authorities can charge a local surtax on top of the 5.6% rate, which increases the seller's total TPT rate. Your business may need a transaction privilege tax or business license from the local Arizona jurisdictions where the company has operations.

Businesses with several different locations in Arizona have two options:

- Get a separate license for each site and report each location individually.

- Get a consolidated license and report total sales for all locations together.

Local Sales and Use Tax Tables

We recommend using Arizona's Sales Tax Rate Locator, which allows you to search for sales tax rates by address. You can also use this map lookup tool if you don't have an exact address.

The following tax table shows the additional taxes charged by each county and city.

« The county and city tax rates vary by industry. For example, sales tax on hotels, restaurants, and bars is often higher than the tax rates for other retail items and services. For this reason, the city tax rates in the chart below are the average tax rate across all industries.

*Exact tax rates vary by industry.

I Should Have Collected Arizona Sales Tax, But I Didn't

Businesses that should have collected Arizona TPT but didn’t will have limited options for becoming compliant. If you determine your business has nexus, but you have not collected Arizona sales tax, here are your options:

1. Register and pay the full tax liability (including accrued interest and penalties), or

2. Complete a Voluntary Disclosure Agreement (VDA) to potentially cut penalties (and, in some cases, reduce your tax liability).

Here is what you need to know about each option to make the best decision for your business:

Option 1: Register to Pay Back Taxes, Penalties, and Interest.

A VDA is not always cost-effective if the past liabilities and penalties are minimal. Sometimes the best solution for a business is to register with Arizona and pay your outstanding balance. Be cautious of the tax professionals that recommend a VDA in these cases. They may be looking to make a buck rather than looking out for your best interests.

When to consider registration and payment:

- Your nexus with Arizona is less than 4 years.

- Your accrued penalty is LESS than the professional fees necessary to process the VDA.

- Your business does NOT have a TPT collected issue (i.e., you never charged and collected Arizona TPT from customers).

Beware: Registering does not generally end past liabilities and you may have increased risk of audit.

If you're unsure what your past liabilities are, contact us. Our state tax professionals work with you so you can make the right choice for your business.

Option 2: Voluntary Disclosure Agreement (VDA)

Arizona's lookback period: The standard lookback period is four years; however, the ADOR determines this on a case-by-case basis.

A VDA may be a good option for you if:

- Your Arizona nexus extends well beyond 4 years.

- Your penalty is MORE than the cost of a VDA.

- You collected Arizona TPT from customers but failed to remit to the ADOR.

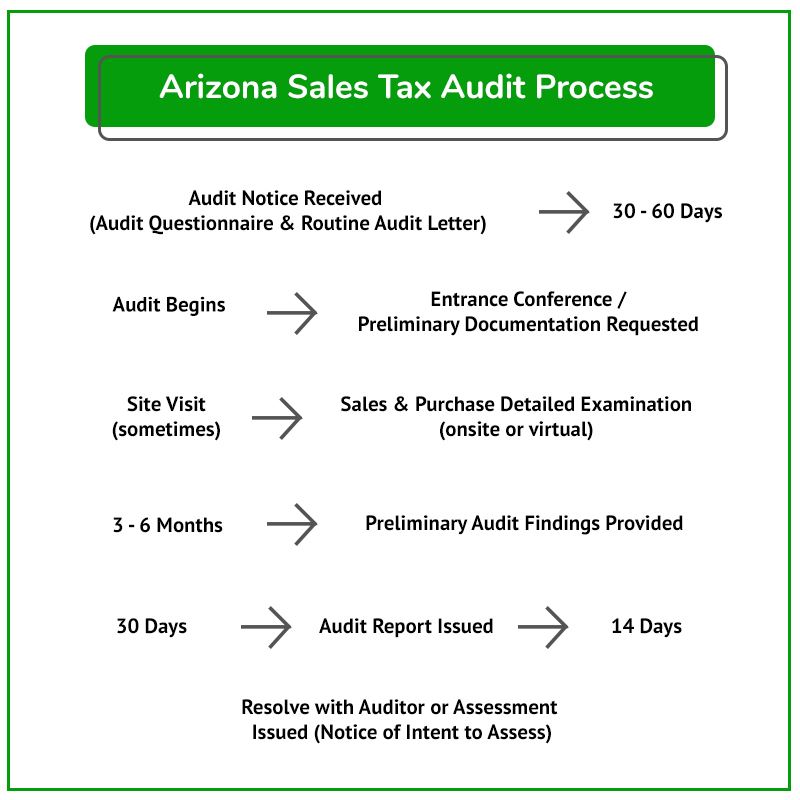

What to Expect During an Audit

The average audit process can be seen in the flowchart below, including detailed guidance for each stage of the process.

Arizona regularly audits businesses required to charge, collect, and remit various taxes in the state.

Many audits begin with a call from an Arizona Department of Revenue's sales tax auditor followed by receipt of a Notification of Intent to Audit. Controlling the audit process is essential for defending your tax position and avoiding unfair assessment.

Meeting with a state and local tax professional after receiving notice of an audit can be useful to prepare and navigate interactions with the ADOR.

I Received an Arizona Sales Tax Audit Notice. What Should I Do?

Questions to help you gauge your ability to manage an ADOR audit without assistance:

- What is your TPT audit experience? How will you know if the ADOR auditor is following proper procedures?

- Do you know when you can challenge the request to view sensitive business documents?

- Do you have any idea what your TPT liability could be?

Unless you can confidently answer these questions, hiring a professional could be a valuable option for your business. Contact us to learn how our sales tax professionals can give you the peace of mind and confidence during an audit.

Visit our resource pages for more information to help inform decisions about how to handle an Arizona TPT audit.

- The Audit Overview & Selection Process

- The General Audit Process

- Statute of Limitations Extensions & Issues

- Managing the Sales Tax Auditor

What to Expect from an Arizona Sales Tax Auditor

If you want to know what to expect from an auditor, it can be helpful to see things from their perspective. What better way to do that than to read the playbook they use to conduct an audit? With that in mind, here is the Arizona TPT Audit manual for your review. In the interest of time, we've summarized some of the process below.

If you have questions about your audit, contact us for a review with one of our tax professionals.

- The auditor performs pre-audit research.

- The auditor holds an entrance conference with the taxpayer.

- The auditor may request additional records (some of which may not be relevant or within the scope of the audit)

Once the auditor has all available information, they will compare your Arizona SUTRs to your federal income tax returns or bank statements to determine whether you reported all applicable or gross sales.

NOTE: A slight error in how the tax was charged on even a single type of transaction can add up to a significant sales tax liability.

Once the auditor knows your transaction data, they will:

- Review your exempt and out-of-state sales.

- Conduct a use tax audit – the auditor will request documents of accounts to make sure use tax was paid adequately on applicable purchases.

Common areas audited include the purchase of the following business expenses where the business has an obligation to pay TPT in Arizona for its use in the state:

- Advertising Expense

- Auto & Truck Expense

- Repair and Maintenance

- Rent (including related party rent)

- Office Expense

- Miscellaneous Expense

- Supplies

- Equipment

How Does an Audit End?

The auditor will hold an exit conference with the auditor where they produce an audit report with corresponding work papers to support the Arizona TPT assessment.

We generally advise having a sales tax professional present for this meeting. This will be your first opportunity to review the auditor's findings and is also your first opportunity to challenge miscalculations, missteps in procedure, and other errors. Avoid agreeing to the sales tax assessment until after a sales tax professional has reviewed the audit report for issues to contest.

| Many businesses overpay the state because they don’t understand the sales tax laws that, if challenged, could have reduced their TPT liability. |

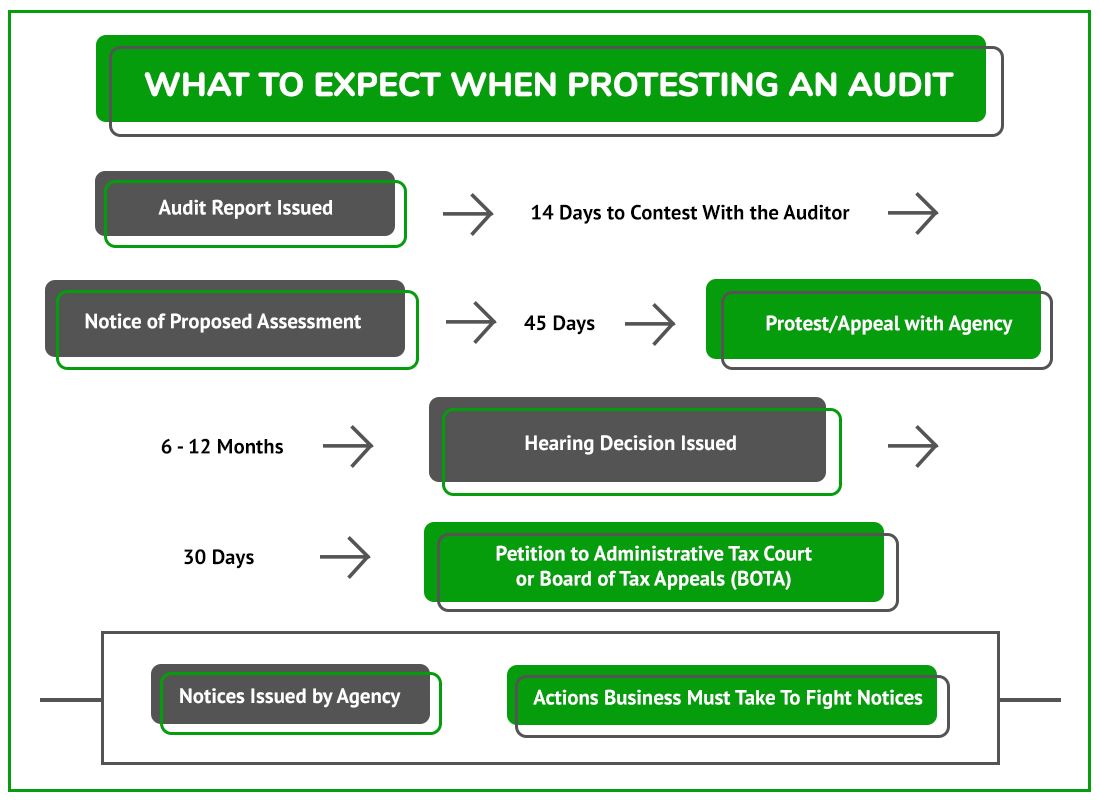

Contesting Audit Findings with the Auditor

Arizona Sales Tax Audit Protest Process Flow Chart

NOTE: After missing a deadline, you have a short period of time to pay the tax and seek a refund. If that deadline is also missed, it can be very difficult to reopen the case.

After the exit conference, the auditor will issue an Arizona Notification of Audit Results (AKA the audit report). The audit report details the auditor's findings. It's essential to review and understand its implications carefully.

Audit Closing Conference

After reviewing and finalizing the work papers, the auditor will schedule a closing conference.

During the conference, the auditor will:

- Explain any proposed audit adjustments.

- Provide a due date for any further adjustments.

If a taxpayer believes there is an error, that taxpayer should contact the auditor to discuss necessary changes before the due date.

You generally handle any issues with the results afterward as follows:

The taxpayer can protest the findings with the ADOR.

1. Issues related to exemptions, proof of paid tax, and calculations are worth addressing with the auditor.

2. Legal interpretations of TPT law are often not resolvable at this stage.

Appeal/Protest with The Arizona Department of Revenue

Protest Rights and Audit Finding Confirmation

Taxpayers who disagree with an audit's findings have 45 days from the receipt date of the proposed assessment to file an appeal with the Office of Administrative Hearings. See the Arizona Taxpayer Bill of Rights for added details on your appeal rights and process involving TPT.

- The appeal form is provided with the proposed assessment, and a timely protest made in writing.

- The appeal must state why the assessment, the tax, interest, and/or penalties are incorrect.

- You only have 45 days from the date of the Proposed Assessment Issuance to appeal.

The case proceeds to a formal hearing if you cannot resolve the matter during the informal review. During the hearing, the taxpayer, or its representative, presents its case to the ADOR. The Hearing Officer, who also happens to be a member of the Arizona Department of Revenue, will then provide a written decision on the case.

If you miss the 45 days, you may have additional time to pay the tax and file a refund claim in some cases.

Once you miss both periods, the assessment becomes final and reopening the audit is difficult.

If you have received a Proposed Assessment and haven't talked to someone experienced in Arizona State and Local tax, now is the time. Do it before missing key deadlines.

Final Decision from the ADOR

If you cannot resolve the Arizona sales and use tax dispute through the protest/appeal process, the Arizona Department of Revenue will issue a Final Decision.

The Position Letter is an opportunity to:

- File an appeal with the Board of Tax Appeals within 30 days of the decision’s issuance; or File in Arizona's tax/administrative court, the Arizona Tax Court.

You only have 30 days from receiving a notice of determination to file in administrative court.

Settling an Arizona Sales Tax Liability

After any one of the critical notices is issued, it's possible to settle your Arizona sales tax case with the Arizona Department of Revenue by filing an Arizona Offer in Compromise. Often, it’s possible to negotiate better results here than with the auditor. However, the business must meet certain criteria to qualify, as explained by the Department.

Without experience and knowledge of Arizona tax laws, knowing a fair settlement from an unreasonable one will be challenging.

DO NOT attempt to negotiate a settlement without an experienced Arizona state and local tax professional.

How to Contest an Arizona Jeopardy Assessment

Arizona may issue a Notice of Jeopardy Determination in certain situations. The jeopardy assessment gives the Arizona Department of Revenue the right to try to collect immediately. Due to the jeopardy nature, the taxpayer only has 20 days to contest the assessment and must place a security deposit to fight the issue.

Arizona Tax Court

After exhausting appeal and settlement options with the Board of Tax Appeals, you still have one chance to fight your Arizona TPT assessment: The Arizona Tax Court. Appeals to the Tax Court must be done within sixty days of receiving your decision from the Board of Tax Appeals.

Neither party wants to spend the time and resources on the uncertainty of administrative court. So, continuing to challenge the assessment can be an effective way to maximize your settlement potential. If your case is filed in tax court, the case proceeds to a hearing before a neutral tax judge. The process is similar to a court hearing and having an experienced representative is imperative.

Our team has handled hundreds of administrative court cases. It can help your company receive the resolution you are entitled to. Get in touch with us today.

Other Arizona Sales Tax Resources

- Arizona Department of Revenue Sales Tax Website

- Arizona Revised Statutes- Title 42 - Taxation

- Arizona Tax Notices

- Transaction Privilege & Use Tax Procedures

- Transaction Privilege & Use Tax Decisions

- Transaction Privilege & Use Tax Letter Rulings

- Transaction Privilege & Use Tax Rulings

- Transaction Privilege & Use Tax Notices

- Additional Use Tax Rulings

Reviews

-

"Take Control of your sales tax with easy-to-use DIY tools. Get the guidance you need - without the high cost of full-service support."

Meet David, the Auto Repair Shop Owner (DIY)

- The DIY Business Owner -

"Get expert answers when you need them. Our on-demand consulting service connects you with tax professionals for quick, reliable advice—without long-term commitments."

Meet Mark, the Business Owner Who Needs Quick Answers

- The On-Demand Consultant User -

"Outsource your sales tax headaches to proven experts. Our full-service solutions handle compliance, audits, and dispute resolution—so you can focus on growing your business."

Meet Greg, the CFO of a Multi-State Manufacturing Company

- The Managed/Enterprise CFO -

"Stay in control while getting expert help when you need it. Our guided sales tax solutions give you access to professionals for compliance, audits, and appeals—without the cost of full-service management."

Meet Kris, the Multi-Store Gas Station & Convenience Operator: Multi-Location Owner (Guided Support)

- The Guided Business Owner -

"Jerry is the best!"

Jerry is the best! I made the mistake thinking I could deal with the use tax auditor on my own not realizing that I would be ...

- Gary O. -

"Sales Tax Helper Can Make Miracles Happen"

Sales Tax Helper can make miracles happen. Jerry was able to wipe hundreds of thousands of dollars off a NY sales tax bill ...

- Zalmi D. -

"I Will Definitely Be Using His Services Again"

Jerry was very helpful and listened to all our concerns. I will definitely be using his services again.

- Joyce J. -

"Representing Our Company Professionally"

Owning a Texas car dealership is demanding work, so taking on a Texas Sales Tax Audit was a daunting task for us – we didn’t ...

- Ata A.