New York Sales and Use Tax & Audit Guide

This guide is for businesses that need clear answers to the following questions about the New York Sales and Use Tax:

- Do I need to collect sales tax in New York?

- Should I be paying New York use tax?

- What do I do if I was supposed to collect but haven’t?

- I got a notice of audit from New York. What should I do?

- How to fight a New York sales tax assessment.

Who Needs to Collect New York Sales and Use Tax?

Like in most states, for your business to be subject to New York's sales tax collection and rules, it must:

- have nexus with New York, and

- sell or use something that is subject to New York sales tax.

How Do You Create Nexus in New York?

According to the New York Department of Taxation and Finance, sales tax nexus is created in New York if a business has a physical presence in New York, such as:

- Soliciting business in New York, including through the use of an employee or agent.

- Maintaining a place of business in New York (e.g., a storefront or office).

- Servicing tangible personal property in New York (e.g., installations or repairs).

- Performing certain services to real property in New York.

- Owning, renting, or leasing property, personal or real, in New York.

- Delivering goods to New York customers using your company-owned or leased truck.

- Maintaining inventory in New York using a third-party fulfillment service, such as Fulfilled by Amazon (“FBA”).

Also, a business that doesn't have a physical location in New York can establish economic nexus by making more money in the state than a certain amount each year. Details are in the next section.

Economic Nexus (Wayfair Law) And Internet Sales in New York

As of June 21, 2018, sales and use tax laws may also apply to businesses that aren't in New York. In particular, New York's Wayfair law says that a business that operates only outside of the state must sign up with CDTFA to collect and pay sales and use tax if it made more than $500,000 in sales of tangible personal property delivered into New York in the previous or current calendar year.

Which Sales Are Subject To New York Sales Tax?

General Transactions

If you have nexus in New York, the next step is to find out if the products or services you sell are subject to New York sales and use tax. Like most states, New York has a sales tax on sales and rentals of tangible personal property, unless the item is specifically exempt.

Even though the general rules seem simple, the details, complexities, and how they apply to your business can make New York's sales tax rules hard to follow. We suggest making an appointment with one of our sales tax experts to talk about your situation. Common exemptions from New York sales and use tax:

- Certain food and beverage items

- Drugs, medicine, and medical equipment

- Newspapers

- Feminine Hygiene Products

- Manufacturing machinery or equipment and associated utilities and fuel

Services

In New York, sales tax does not usually apply to services. But the following are some examples of services in New York that could be taxable:

- Certain information services

- Servicing or repairing real property

- Interior design services

To make things even more complicated, New York City taxes other services that are done in the city:

- beautician services, barbering, and hair restoring

- tanning

- manicure and pedicure

- electrolysis

- massage services

- services provided by weight control and health salons, gymnasiums, Turkish and sauna baths, and similar facilities, including any charge for the use of these facilities

- written or oral credit rating services

- oral credit reporting services not delivered by telephone

Software

Pre-written software is subject to a sales tax in New York, whether it is delivered on a physical medium or downloaded. Taxes do not apply to custom software. Software that can be used remotely and SaaS are usually taxed.

Shipping & Handling

New York has traditional rules with respect to shipping and handling charges. The basics are as follows:

Shipping of non-taxable items:

If the item being delivered is not taxable, the delivery charge is also non-taxable.

Shipping of taxable items:

When a taxable product or service is sold, any charge for shipping or delivery is also taxable.

Shipping of taxable & nontaxable items:

When both taxable and nontaxable items are combined into a single charge, the entire sale is taxable.

If the nontaxable charge is separately stated, sales tax does not apply to the nontaxable item.

Further, if the delivery charge is fairly allocated between the taxable and nontaxable items, only the shipping allocated to the taxable charge is taxable.

Industry-Specific Guides for New York Sales Tax

Even though the general sales tax rules seem clear, they can be hard to follow when gray areas exist in your industry. These guides were made by New York to give advice on specific industries and topics:

Determining Local Sales and Use Tax Rates in New York

Base or statewide sales tax rate in New York is 4%. But counties, cities, school districts, and transit authorities can also charge a sales tax. So, the total sales and use tax rate for a given sale is the sum of the state rate and any local taxes that apply.

In New York, a 0.375% tax is added to all taxable sales made within the Metropolitan Commuter Transportation District (MCTD).

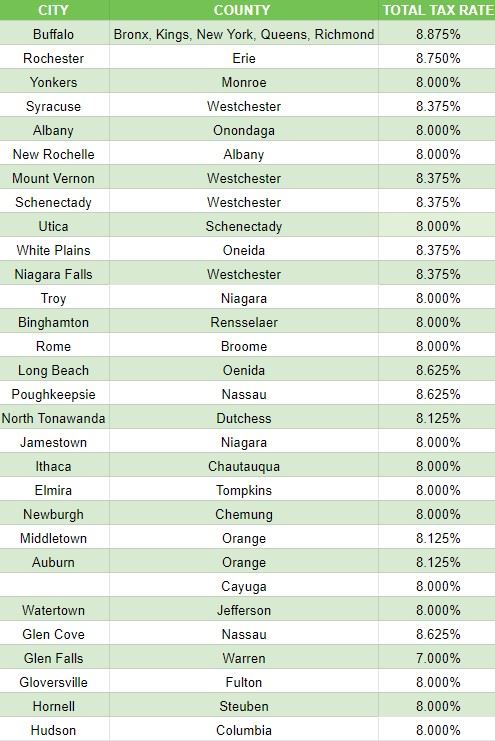

The district surtax is added to the price if the sale is made or delivered within the county. As part of New York's sales and use tax return, district surtaxes are sent to the state. As of August 1, 2019, the following table shows the combined sales and use tax rates for the 30 largest cities in New York and its counties.

Here is a complete list of New York’s local sales tax rates.

I Should Have Collected New York Sales Tax, But I Didn’t

If you determine your business has nexus but you have not collected New York sales tax, the primary options are to:

- Register and pay back taxes, penalties, and interest, or

- Enter into a VDA to eliminate penalties (and in some cases reduce your tax liability and avoid interest).

Unlike many of our competitors, who blindly suggest filing a Voluntary Disclosure Agreement (VDA) in every state, our sales tax experts will work with you to find the most cost-effective solution for your business.

Here is what you need to know about each option to make an informed decision about voluntary disclosure for your business:

Option 1: Register to Pay Back Taxes, Penalties, and Interest

Sometimes the best thing for a business to do is just to register with New York and pay back taxes, penalties, and interest. A VDA is not worth the money if accrued liabilities and penalties are small. Be wary of tax experts who tell you to do a VDA in these situations. They want to make money instead of looking out for your best interests. If you don't know what your past liabilities are, contact us. One of our state tax experts will work with you to do an analysis and help you make the best decision for your business.

When to consider registration and payment:

- Your nexus is less than 3 years old.

- The sales tax penalty is LESS than the professional fees charged for the VDA.

- Your business does NOT have a sales tax collected issue.

Note: registering does not eliminate past liabilities and your business will be responsible for their payment to the NYDTF.

Option 2: Voluntary Disclosure Agreement (VDA)

New York’s VDA lookback period: 3 years.

Voluntary disclosures are often a good way to cut down on long periods of past exposure. For example, if you should have been collecting sales tax for 10 years but didn't, the voluntary disclosure limits the lookback period (and associated liability) to 3 years. So, the benefit of doing a VDA usually depends on:

- Whether the VDA would limit your lookback period. i.e. – your nexus is more than 3 years old.

- The sales tax penalty savings is MORE than the professional fees charged for the VDA.

- You have a sales tax collected but not remitted issue.

I Received a New York Sales and Use Tax Audit Notice, What Should I Do?

Businesses required to charge, collect, and pay taxes in New York are audited regularly based on a variety of factors like past compliance, industry, and random selection. When a business gets a notice of a sales and use tax audit, they should think about:

- How can you be sure that the state's auditor is following the rules and doing things the right way if you haven't dealt with New York sales and use tax audits before?

- How will you know when to push back or when to give documents?

- Do you have a good idea of where your sales and use tax risks lie?

- Controlling the audit is the most important thing you can do to limit your risks and shape the results. Are you able to do that by yourself?

If you don't know the answers to these questions and don't have any experience with New York sales tax audits, you might want to hire a professional.

Contact us to find out how our sales tax experts can give you the confidence and peace of mind you need during your audit.

Please visit our resource pages for more detailed information and to help you make important decisions during your New York sales and use tax audit.

- The Audit Overview & Selection Process

- The General Audit Process

- Statute of Limitations Extensions & Issues

- Managing the Sales Tax Auditor

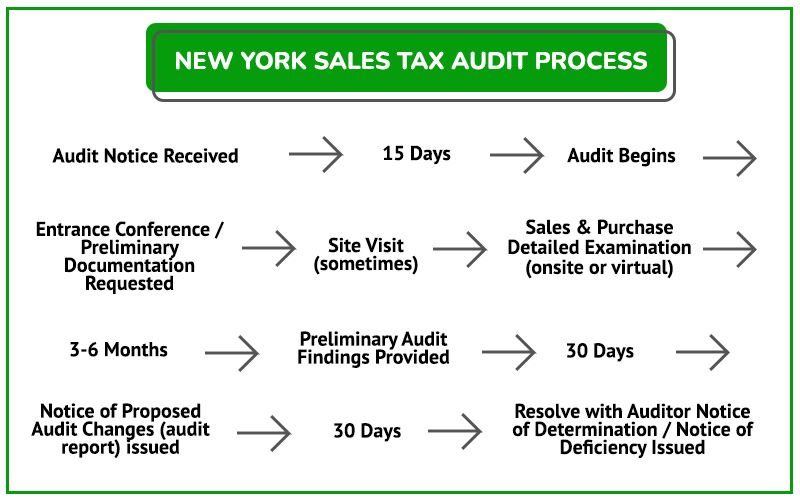

New York Sales Tax Audit Process

This flowchart shows how the auditing process usually works. See the sections below for more information on each step of the process.

What to Expect After You Receive a New York Sales and Use Tax Audit Notice

A New York Department of Taxation and Finance sales tax auditor will often call to inform you of audit selection. Shortly after the phone call, your business will get an audit notice for either a field or desk audit, which provides formal notice. To get ready for the audit, it's probably a good idea to start by talking to a state and local tax expert.

What to Expect From A New York Sales Tax Auditor

- The auditor will conduct pre audit research.

- The auditor will often schedule an entrance conference.

- The auditor will request records will be requested (many of which the auditor may not be entitled to review as part of the audit).

What to Expect During The Audit

Most New York sales tax audits go back three years. An audit can take anywhere from a few days to a year or more, depending on how complicated the business is and how complete and correct the records are.

Once the auditor has all the necessary records, he or she will:

- Compare your New York sales and use tax returns to your federal income tax returns or bank statements to find out if all applicable sales, or gross sales, were reported on your New York sales tax return (s).

- Once the auditor is confident all sales are accounted for, they will review your exempt and out-of-state sales.

- Conduct a use tax audit on your expenses– the auditor will request a detail of certain accounts and receipts to make sure use tax was properly paid on applicable purchases. Commonly audited purchases include:

- Advertising Expense

- Auto & Truck Expense

- Repair and Maintenance

- Rent (including related party rent)

- Office Expense

- Miscellaneous Expense

- Supplies

- Equipment

Despite publications to the contrary, if a business buys an item online without paying use tax, the business still has an obligation to remit the tax to New York. This often leads to shocking results for the unsuspecting taxpayer during an audit.

NOTE: A slight error in how tax was charged on even a single type of transaction, when multiplied over many years, can create a considerable sales tax liability.

After the Audit – Understand and Defend Your Businesses Rights

Usually, there will be a meeting with the auditor after the audit is done. To support the New York sales and use tax assessment, the auditor will make an audit report called a Statement of Proposed Audit Changes along with related workpapers. At this meeting, it's best to have a sales tax expert with you because it's the first time you'll get to see the auditor's findings and tell them where they've gone too far or misapplied New York's sales tax laws.

We suggest that businesses don't sign the Statement of Proposed Audit Changes or the Notice of Determination/Deficiency until a sales tax expert has reviewed it for any problems that you could contest. Many businesses end up paying the state a lot more than they should because the business owner or in-house accounting staff did not know enough about the sales tax laws that, if challenged, could have lowered their New York sales tax liability.

In the sections that follow, we'll talk more about the process for challenging a New York sales tax audit assessment.

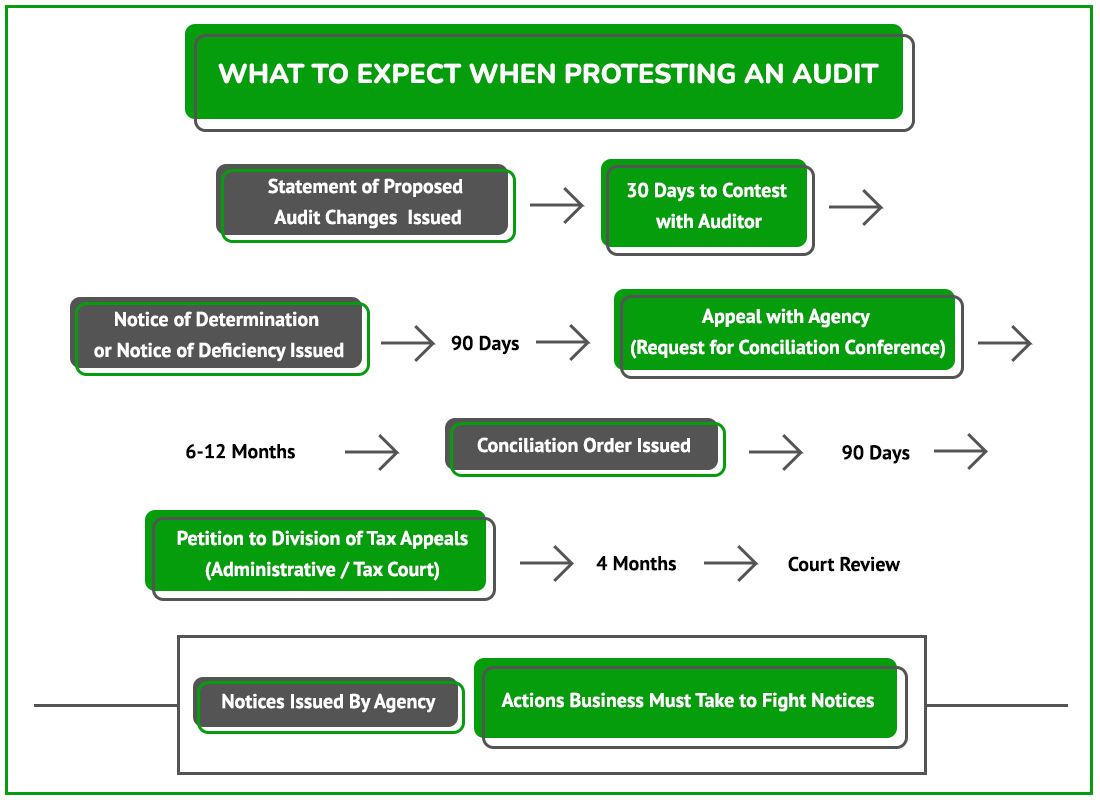

New York Sales Tax Audit Protest Flow Chart

NOTE: A conciliation conference is a good way to try to settle your New York sales tax audit informally. But if you can't solve it through conciliation, you can still ask the division of tax appeals to hear your case.

Contesting Audit Findings with the Auditor

After an audit, the auditor will issue a New York Statement of Proposed Audit Changes (AKA the audit report). This document details the auditor’s findings so it’s important to carefully review and understand its implications. Any issues with the results are handled as follows:

- Your business, as the auditee, has 30 days to disagree with the auditor's findings.

- Documentation issues (exemption certificates, proof that taxes were paid, etc.) and math problems are good issues to address with auditor because they will have the authority to fix them.

- However, disagreements about New York’s sales tax laws are often hard to resolve because of the auditor’s directives from supervisors.

- If you can't work things out with the auditor, the next step is to appeal or protest the issue with the New York Department of Taxation and Finance through a Conciliation Conference.

Appeal / Protest with the New York Department of Taxation and Finance

The auditee can protest or appeal any disputes that weren't settled before the issuance of the audit report. This is done after the New York Department of Taxation and Finance sends the Notice of Determination or Notice of Deficiency and involves the following steps:

- A protest or appeal must be filed within 90 days of receiving a Notice of Determination/Deficiency (NOD), unless the NOD specifies a different time limit.

- You can file a Request for Conciliation Conference with the agency to protest or appeal your New York Sales Tax audit informally.

- You can also protest or appeal the results of your New York Sales Tax audit in a formal way by filing a petition with the New York Division of Tax Appeals, but we usually recommend attempting resolution with the Conciliation process first.

- If you got a Notice of Determination and haven't talked to someone with experience in New York State and Local tax yet, now is the time to do so before appeal deadlines pass.

New York Sales Tax Conciliation Order

If you cannot resolve the New York sales and use tax dispute through the protest process, the New York Department of Taxation and Finance will issue a Conciliation Order.

The Conciliation Order gives you the opportunity to agree or formally appeal the assessment in New York’s administrative court, which is called the New York Division of Tax Appeals. There are important deadlines, such as 90 days to file in a petition with the New York Division of Tax Appeals (i.e., administrative court).

Settling a New York Sales Tax Liability

You can sometimes negotiate with the New York Department of Taxation and Finance to settle your New York sales tax case or participate in the NYDTF’s Offer in Compromise Program. This option is available even after a critical notice has been sent. Most of the time, you can do better here than with the auditor. If you or your tax professional don't do much work with state and local taxes, it might be hard to tell whether a settlement is fair or not. DO NOT try to reach a settlement without a New York state and local tax lawyer or other professional with experience.

Contest a New York Jeopardy Assessment

In some situations, New York may send out a Notice of Jeopardy Determination. This potentially dangerous assessment gives the New York Department of Taxation and Finance faster rights, so it could start trying to collect right away by seizing accounts and taking possession of property. Due to this risk, the taxpayer only has a short time to dispute the assessment and must put up a security deposit to do so.

New York Administrative Court

If you miss the NOD deadlines, you can still fight your New York sales tax assessment by petitioning to the New York Division of Tax Appeals. Also worth noting is that you can always skip the agency protest and go straight to administrative court, but we only recommend this in certain circumstances. Since neither side usually wants to spend time and money on the uncertainty of administrative court, continuing to challenge the assessment is often a good way to increase your chances of reaching a settlement.

If you take your case to administrative court and it goes to hearing, a neutral administrative law judge will decide your case and issue an order. Our team has dealt with hundreds of administrative court cases and can help your company get the resolution it deserves at this stage of your appeal. It's a lot like a court hearing, and having an experienced representative could be beneficial.

Other New York Sales Tax Resources

- New York Department of Taxation and Finance Website

- New York Department of Taxation and Finance Resale Certificate Information

- New York Department of Taxation and Finance Vendor Lookup

- New York Department of Taxation and Finance Taxpayer Advisory Opinions

- New York Division of Tax Appeals Tribunal Decisions

Reviews

-

"Jerry is the best!"

Jerry is the best! I made the mistake thinking I could deal with the use tax auditor on my own not realizing that I would be ...

- Gary O. -

"Sales Tax Helper Can Make Miracles Happen"

Sales Tax Helper can make miracles happen. Jerry was able to wipe hundreds of thousands of dollars off a NY sales tax bill ...

- Zalmi D. -

"I Will Definitely Be Using His Services Again"

Jerry was very helpful and listened to all our concerns. I will definitely be using his services again.

- Joyce J. -

"Representing Our Company Professionally"

Owning a Texas car dealership is demanding work, so taking on a Texas Sales Tax Audit was a daunting task for us – we didn’t ...

- Ata A. -

"Responsive and Provide Invaluable Knowledge"

Salestaxhelper.com is run by true professionals that understand the complexities of operating a multi-state business. They're ...

- Brennan A.