Tennessee Sales Tax & Audit Guide

Straightforward Answers to Your Tennessee Sales Tax Questions.

- Do I need to collect Tennessee sales tax?

- Should I be collecting or paying Tennessee use tax?

- What do I do if I should have been collecting but haven't?

- I received an audit notice. What should I do?

- Guidance on fighting a sales tax assessment in Tennessee.

Who Needs to Collect Tennessee Sales and Use Tax?

Like most states, to be subject to Tennessee sales tax collection and its rules, your business must:

1) Have nexus with Tennessee, and

2) Sell or use something subject to Tennessee sales tax.

How is Nexus Established in Tennessee?

According to the Tennessee’s Department of Revenue, sales tax nexus is created in Tennessee if a business has a physical presence in Tennessee, such as:

- Having an office, distribution point, sales center, warehouse, or any permanent or temporary physical location in Tennessee.

- Having independent sales reps, employees, or agents conducting business in the state, including selling, delivering, or taking orders for taxable items in Tennessee.

- Directly or indirectly furnishing taxable services in Tennessee

- Owning or leasing tangible property located in Tennessee

- Performing construction contracts in Tennessee

- Participating or having company personnel participating in trade shows

- Using company-owned trucks to deliver goods within Tennessee

- Having a subsidiary with a physical presence in Tennessee

- Assembling, installing, servicing, or repairing products in Tennessee.

- Maintaining inventory in Tennessee using a third-party fulfillment service, such as Fulfilled by Amazon (“FBA”).

Additionally, businesses that do not have a physical presence in Tennessee can establish economic nexus by exceeding a certain annual sales threshold in Tennessee. See the next section for details.

Economic Nexus (Wayfair Law) and Internet Sales in Tennessee

Tennessee introduced a new dollar-based standard for businesses with no physical presence in Tennessee. This is known as economic nexus.

A remote seller [JD1] [GU2] sells tangible personal property or taxable services for delivery into a state via the Internet, catalog, or telephone but has no physical presence in that state.

The result of the Wayfair decision is that states may now impose sales tax obligations on remote sellers.

Tennessee now requires that out-of-state businesses (a.k.a. remote sellers) register with the Tennessee Department of Revenue and collect and remit sales and use tax if the business has a total sales revenue in the state of more than $100,000 in the preceding twelve calendar months.

Total sales revenue, as defined by Tennessee, includes the following:

Gross revenue from all taxable and non-taxable sales of tangible personal property and services in Tennessee to individuals, businesses, and organizations. However, you should not include sales to another dealer for resale.

EXAMPLE: If the threshold was met on January 15, 2020, you must register, collect and remit sales tax beginning on April 1, 2020, for any sales made after that date.

|

Note: The sales threshold in Tennessee was $500,000 but was changed to $100,000 effective October 2, 2020. Once the $100,000 sales threshold is exceeded, the seller must obtain a permit and begin collecting Tennessee sales and use tax no later than the first day of the third month.

Marketplace Sellers

If your business sells on Amazon or a similar marketplace provider, you may not have to collect sales tax on those sales. Specifically, if the marketplace provider certifies they collect and report sales tax on your behalf, you are off the hook. However, such sales may count towards your total sales threshold, potentially requiring your business to collect tax on sales made directly through your website or other marketplaces.

Terminating Tennessee Sales Tax Collection

A common question regarding Tennessee sales tax collection from remote sellers is whether you must indefinitely collect sales tax after initially surpassing the economic nexus threshold. The answer is no. See Sales and Use Tax Account - Closing an Account

EXAMPLE: You terminated your Tennessee sales tax collection obligation, then sales picked up, and you realize that your total sales for the period of January 1, 2021, through December 31, 2021, exceed $100,000. You may stop collecting for the period below the threshold but must resume when the threshold is exceeded. If, during the period of July 1, 2020, through June 30, 2021, a remote seller's total Tennessee revenue exceeds $500,000, the remote seller needs to obtain a permit and begin collecting the appropriate tax no later than October 1, 2021.

|

Tennessee looks only at your business's sales in the preceding 12 calendar months. Thus, if at any time your total sales in Tennessee drop below $100,000 for the last 12 months, you can terminate your collection obligation by submitting a form to the state. Be careful, though, because if your sales pick up a bit, you may exceed the threshold again. When you do, you must resume sales tax collection by the first day of the second month after exceeding the economic nexus threshold .

It’s also important to note that just because you terminate your Tennessee sales tax collection doesn't mean you're 100% off the hook. Tennessee still requires you to comply with its recordkeeping requirements, and you are still subject to its sales tax audits.

Which Sales are Subject to Tennessee Sales Tax?

General Transactions

If you have nexus in Tennessee, the next step is to determine whether the products or services you sell are subject to Tennessee sales and use tax.

Unless an item is specifically exempt, sales and rentals of tangible personal property are subject to Tennessee sales tax.

The rules seem simple, but many details make applying Tennessee’s tax rules to your business challenging.

We recommend scheduling a time to review your specific situation with one of our sales tax professionals.

Common Exemptions from Tennessee Sales and Use Tax:

Exempt items include:

- Textbooks are Exempt from Sales and Use Tax

- Medical Equipment

- STH-2 - Sales Tax Holiday - Qualifying Items

- Prepared Food - Definition and Tax Rate

- Dietary Supplements - Definition and Tax Rate

- Sales and Use Tax for Contractors - Overview

- Many items used in farming or manufacturing.

- Services - Non-Taxable Services in Tennessee

Services

Generally, services are not subject to Tennessee sales tax. However, the following servicesare subject to Tennessee sales tax:

- Room rentals, lodging, or other accommodations for less than 90 consecutive days

- Provision of parking or storing of motor vehicles in a parking garage or parking lot

- Providing repair of tangible personal property and computer software, including situations where no new parts are provided or when the customer furnishes the parts

- Laundering or cleaning any kind of tangible personal property

- Installing tangible personal property that remains tangible property after installation, including stand-alone installation services where the installer did not sell the property installed (the installation of tangible property that becomes a part of realty when installed is not taxable)

- Installation of computer software

- Enriching of uranium materials or compounds

- Providing short-term rental of space to a dealer for making sales

- Furnishing telecommunications services

- Sales of prepaid calling cards, prepaid phones, and long-distance calling cards

- Ancillary associated with telecommunications, such as call waiting & forwarding, caller ID, voice mail, and conference bridging

- Video programming services (i.e., cable and wireless cable and broadband television services)

- Direct-to-home satellite television services

You can find more information on the taxability of services here.

Software

Software as a Service (SaaS) Remotely Accessed Computer Software [Tenn. Code Ann. § 67-6-231]

Generally, remotely-accessed software remains in possession of the seller or the seller's designee and is accessed remotely by the purchaser.

Access and use of software when the software remains in possession of the seller and is remotely accessed by a customer for use in Tennessee is taxable use of computer software. This means that software remains subject to sales and use tax regardless of a customer's method of use.

Examples of remotely accessed software include accounting software, tax preparation software, human resources software, word processing software, and other remotely accessed software applications.

Access to remotely accessed software from a Tennessee location is subject to the Tennessee sales and use tax.

- The seller must collect tax at the state tax rate, plus the applicable local tax rate, on the sales price to use remotely accessed software.

- The tax applies to access and use of the software where the customer's residential or primary business address is a location in Tennessee. It applies regardless of how the customer is charged for use of the software: whether per use, per user, per license, subscription, or any other basis.

- If the seller does not have nexus in Tennessee or otherwise does not collect the tax, purchasers in Tennessee who remotely access and use software must report and pay use tax to the Department of Revenue on the purchase price for the use of the remotely accessed software in the state of Tennessee.

- If the purchaser pays for access to software that will be used by both individuals located within Tennessee and other individuals located outside the state, then the seller may allocate the price paid by the purchaser based on the percentage of users located in Tennessee to determine the amount subject to Tennessee tax.

Remotely accessed software does not include services that are not subject to tax under state law but may be remotely accessed and utilized or received by a purchaser. These are not considered remotely accessed software and continue to be non-taxable services:

- information or data processing services

- payment or transaction processing services

- payroll processing services

- billing and collection services

- internet access

- storage of data, codes, or computer software

- service of converting, managing, and distributing digital products

Prewritten and Custom Software

Both prewritten and custom computer software are taxable in Tennessee when provided to the customer under any of the following conditions:

- in Tennessee on tangible storage medium (e.g., disks and tapes)

- by loading and leaving on the customer’s computer in Tennessee

- by electronic delivery (e.g., download) to the customer’s computer in Tennessee

- by programming in the customer’s computer in Tennessee

- remotely accessed by the customer from a locationin Tennessee (remotely accessed software remains in the possession of the seller while made available to the customer for the customer’s use from a remote location.)

See Important Notice #15-14 for more information.

Computer software provided to a customer that is installed, downloaded, or programmed into the customer's or designee's computer located outside Tennessee is not subject to Tennessee sales or use tax.

If you have questions about your situation, contact usto discuss it with one of our tax professionals.

Shipping & Handling

Tennessee assumes that delivery and shipping charges connected with taxable items or services are taxable.

- If an item of tangible personal property or service is not subject to Tennessee sales and use tax, the delivery charge by the seller for delivering the property or service is also not subject to sales or use tax. For example: sales for resale, sales to nonprofits or government agencies, and sales shipped out of state.

- If an item of tangible personal property or service is subject to Tennessee sales or

use tax, then the delivery charge made by the seller for delivering the item or

service is also subject to sales or use tax.

- If a delivery charge is made for a shipment that includes both taxable and

nontaxable tangible personal property or services, then a percentage of the delivery charge can be allocated to the taxable tangible personal property subject to sales tax.

This allocation can be made in the following ways:

- A percentage based on the total sales price of the taxable property compared to the sales prices of all property in the shipment; or

- A percentage based on the total weight of the taxable property compared to the total weight of all property in the shipment.

- If an item of tangible personal property or service is delivered by an independent

third-party hired by the buyer, and the delivery charges are made to the buyer, then

delivery charges are not made by the seller and are not subject to sales or use tax.

Industry-Specific Guidance

While the general sales tax rules seem straightforward, applying those rules can get tricky when gray areas come up. The Tennessee Department of Revenue developed these guides to provide some industry-specific guidance:

- Tennessee Sales and Use Tax Guide - Aircraft

- Tennessee Taxation of Car and Boat Sales

- Tennessee Sales Tax Guide for Agricultural

- Tennessee Sales Tax Guide Marketplace Sellers

- Tennessee Sales Tax Guide Marketplace Facilitators

- Tennessee Sales Tax Guide Out of State Dealers

- Tennessee Sales Tax on a Vehicle Purchase

- Tennessee Sales and Use Tax - Special Events

Determining Local Sales Tax Rates in Tennessee

Tennessee’s base or statewide sales tax rate is 7%, but some food items carry a 4% rate.

All counties and cities levy the local sales and use tax not higher than 2.75%. The local sales tax rate and use tax rate is the same rate. Local sales and use taxes are filed and paid to the Department of Revenue in the same manner as the state sales and use taxes.

Use this tool to lookup local tax rates in Tennessee.

Local Sales and Use Tax Tables

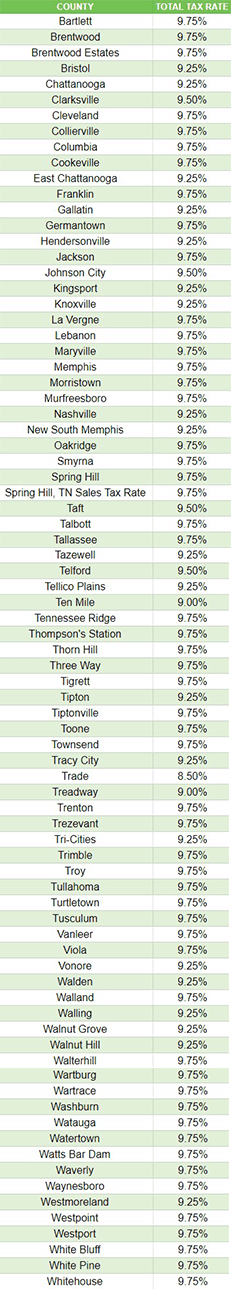

The following tax table shows the total tax rate for each county.

*Exact tax rates vary. Occupancy fees and taxes are not included in this table.

I Should Have Collected Tennessee Sales Tax, But I Didn't

Many of our competitors will suggest Filing a Voluntary Disclosure Agreement in each state. This is a one-size-fits-all solution that isn't always the best. Our sales tax professionals will work with you to determine the best and most cost-effective solution for your business.

If you determine your business has nexus, but you have not collected Tennessee sales tax, here are your options:

1. Register and pay back taxes, penalties, and interest, or

2. Complete a VDA to cut penalties (and, in some cases, reduce your tax liability and avoid interest).

Here is what you need to know about each option to make the best decision for your business:

Option 1: Register to Pay Back Taxes, Penalties, and Interest.

A VDA is not cost-effective if the past liabilities and penalties are minimal. Sometimes the best solution for a business is to register with Tennessee and pay back taxes, penalties, and interest.

Be wary of the tax professionals that recommend doing a VDA in these cases. They are looking to make a buck rather than looking out for your best interests.

When to consider registration and payment:

- If you established nexus less than three years ago.

- The sales tax penalty is LESS than the professional fees charged for the VDA.

- Your business does NOT have a sales tax collected issue.

Beware: Registering does not generally end past liabilities.

If you're unsure what your past liabilities are, contact us. Our state tax professionals work with you so you can make the right choice for your business.

Option 2: Voluntary Disclosure Agreement (VDA)

Tennessee's lookback period: For most filers, the lookback period is based on when the return was due. Any return due from three years of January 1 of the current year will be required to be filed. If sales tax was collected and not remitted, the lookback period would begin with the date you first collected tax.

In many situations, voluntary disclosures are a valuable tool to reduce extended periods of past exposure.

Suppose you should have collected sales tax over the past ten years but didn't. If that is the case, you may benefit from doing a VDA. The voluntary disclosure limits the lookback period to three years.

A VDA may be a good option for you if:

- You established nexus more than 3 or 4 years ago.

- The sales tax penalty savings is MORE than the professional fees charged for the VDA.

- You have a sales tax collected but not remitted issue.

What to Expect During an Audit

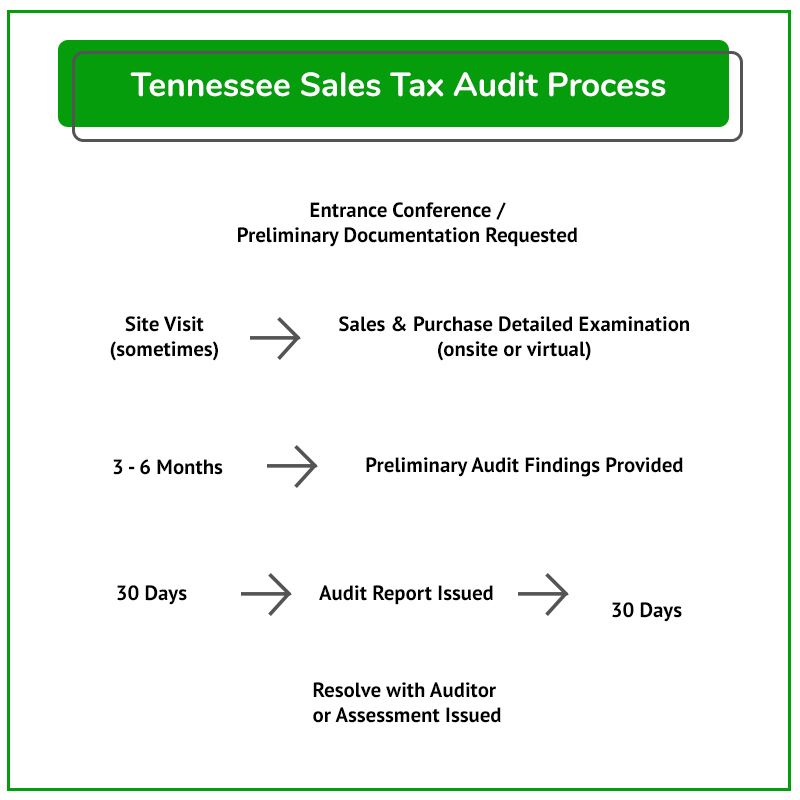

The audit process usually follows the process laid out in this flowchart. See the detailed guidance for each stage of the process in the sections below.

Tennessee regularly audits businesses required to charge, collect, and remit various taxes in the state. Many audits begin with a call from a Tennessee Department of Revenue's sales tax auditor.

However the audit starts, your business will receive an estimated or proposed assessment. From here, you have the opportunity to protest it, as discussed below.

It is good to start with getting a state and local tax professional involved to prepare for the audit.

I Received a Tennessee Sales Tax Audit Notice. What Should I Do?

Businesses that receive a sales tax audit notice need to consider the following questions:

- If you don’t have sales tax audit experience, how can you trust that the state's auditor abides by the rules and follows proper procedures?

- How will you know when to provide documents or when to push back?

- Do you have a thorough understanding of your sales and use tax areas of exposure?

- Controlling the audit is paramount to limiting exposure and shaping the results. Are you confident in doing that on your own?

Unless you can confidently answer these questions, hiring a professional is most likely to be the best option.

Contact us to learn how our sales tax professionals can give you the peace of mind and confidence you’ll need during your audit.

Visit our resource pages for more information to help you make critical decisions during your Tennessee sales and use tax audit.

The Audit Overview & Selection Process

Statute of Limitations Extensions & Issues

Managing the Sales Tax Auditor

What to Expect from a Tennessee Sales Tax Auditor

Tennessee offers this How to Prepare for Audit video for your review, and we've summarized the process below.

For now, here is the summary of the general audit process:

- The auditor will conduct pre-audit research.

- The auditor will often schedule and perform an entrance conference.

- The auditor will request records (many of which the auditor is not entitled to and does not need)

Once the auditor receives the necessary records, they will compare your Tennessee sales and use tax returns to your federal income tax returns or bank statements to determine whether you reported all applicable or gross sales on your Tennessee sales tax return(s).

NOTE: A slight error in how the tax was charged on even a single type of transaction can add up to a significant sales tax liability.

Once the auditor is confident all sales are accounted for, they will:

- Review your exempt and out-of-state sales.

- Conduct a use tax audit – the auditor will request account documents to ensure you paid use tax adequately on applicable purchases.

Common areas audited include:

- Advertising Expense

- Auto & Truck Expense

- Repair and Maintenance

- Office Expense

- Miscellaneous Expense

- Supplies

- Equipment

If you have questions about your situation, contact us to discuss it with one of our tax professionals.

| If a business buys an item online without paying use tax, the business is still obligated to remit the tax to Tennessee. Believing otherwise often leads to shocking results for the unsuspecting taxpayer during an audit. Here is more information on Tennessee Use Tax |

After the Audit – Understand and Defend Your Businesses Rights

Upon completion of the audit, there will usually be an exit conference with the auditor. The auditor will produce an audit report with corresponding work papers to support the Tennessee sales and use tax assessment.

It is advisable to have a sales tax professional present during this meeting. This is your first opportunity to see the auditor's findings. You'll want to push back on areas where they have overstepped their bounds or misapplied Tennessee's sales tax laws.

It's best to hold off on agreeing to the sales tax assessment until a sales tax professional has reviewed it for issues that should be challenged.

| Many businesses wind up drastically overpaying the state because the business owner or in-house accounting personnel weren't well versed in the sales tax laws that, if challenged, could have reduced their sales tax liability. |

We'll cover the process of challenging a Tennessee tax assessment in detail in the following sections.

If you have questions about your situation, contact us to discuss it with one of our tax professionals.

Contesting Audit Findings with the Auditor

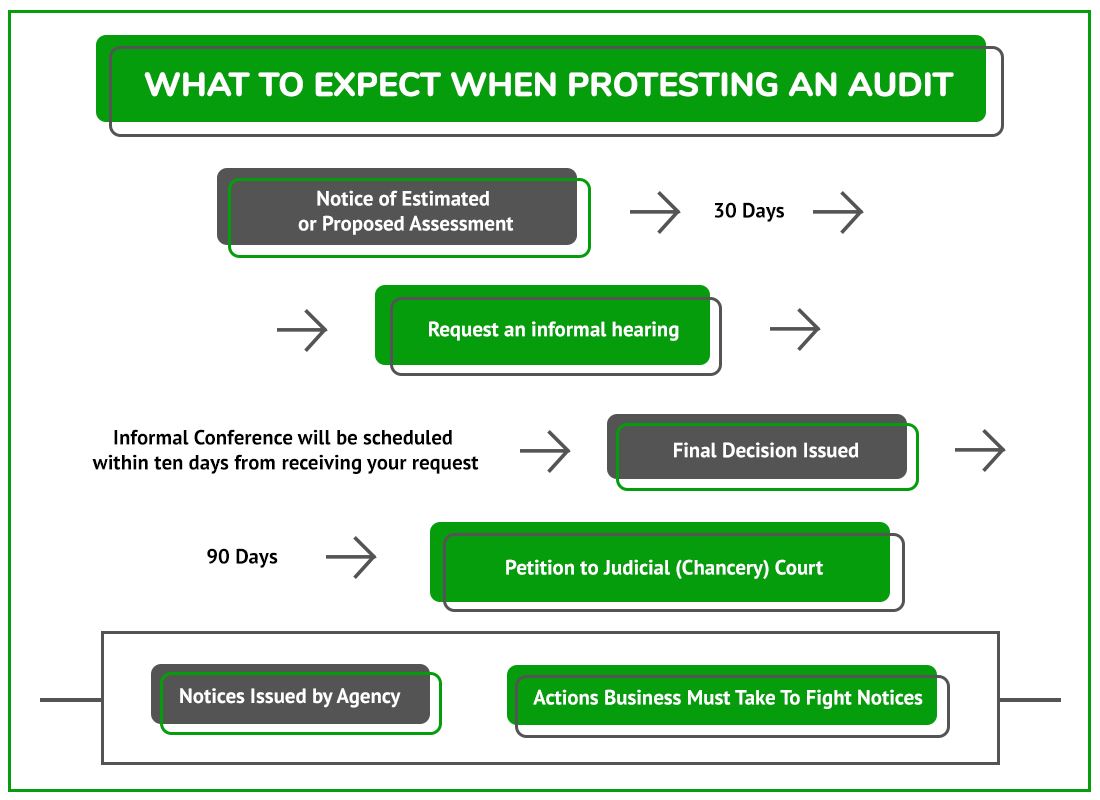

Tennessee Sales Tax Audit Protest Process Flow Chart

NOTE: If the deadlines are missed, you have a short period of time to pay the tax and seek a refund. If that deadline is also missed, it can be challenging to get the case reopened.

Audit Closing Conference

After reviewing and finalizing the work papers, the auditor will schedule a closing conference.

The auditor provides the draft audit results during this conference.

During the conference, the auditor will:

- Explain any proposed audit adjustments to the taxpayer.

- After explaining the results, the auditor will provide a due date for further adjustments.

If a taxpayer believes there is an error, that taxpayer should contact the auditor to discuss necessary changes before the due date.

Any issues with the results are handled as follows:

The taxpayer has a short period to contest the findings with the auditor.

1. Issues related to exemptions, proof of paid tax, and calculations are worth addressing with the auditor.

2. Legal interpretations of sales tax law are often not resolvable at this stage. [JD3] [GU4]

If a resolution cannot be reached with the auditor, the next step is to appeal/protest the issue with the Department of Revenue.

Appeal/Protest with The Tennessee Department of Revenue

Protest Rights and Audit Finding Confirmation

If you disagree with the proposed or estimated assessment, you have 30 days to request an informal hearing.

- If you do not request an informal conference or make an untimely request for an informal conference, the proposed assessment will automatically become a final assessment on the 31st day after the date of the notice of the proposed assessment.

- If you cancel your timely informal conference, the proposed assessment will become a final assessment on the date you notify the Department in writing of the cancellation or on the 31st day after the date of the notice of proposed assessment, whichever is later.

If any deadlines in the process are missed, the assessment becomes final, and it isn't easy to reopen the audit.

If you have received a Proposed Assessment and haven't talked to someone experienced in Tennessee State and Local tax, now is the time. Do it before these deadlines are missed.

Final Decision

If you request an informal conference promptly, the proposed assessment will become final after the informal conference process concludes.

If the Commissioner does not allow an adjustment, the proposed assessment will become final as of the date of the Commissioner’s written decision.

If the Commissioner allows an adjustment, a written determination will be issued stating the amount of tax due. That amount will be the final assessment.

Settling a Tennessee Sales Tax Liability

After any one of the critical notices is issued, it's possible to settle your Tennessee sales tax case with the Tennessee Department of Revenue by filing a Tennessee Offer in Compromise.

To qualify, the business must meet specific criteria. Often, you can get better results negotiating here than with the auditor, but without experience and knowledge of Tennessee tax laws, knowing a fair settlement from an unreasonable one will be challenging.

DO NOT attempt to negotiate a settlement without an experienced Tennessee state and local tax lawyer or other professional.

Chancery Court

Suppose you can't resolve the case within the agency. Or maybe you have missed your deadlines. There's still one chance to fight your Tennessee sales tax assessment: The Judicial/Chancery Court.

If you wish to contest the final assessment without making payment, you have 90 days to file in chancery court. It is similar to a court hearing, and having an experienced[GU5] [GU6] representative is imperative.

Interest will continue to accrue at the prevailing rate until payment is received. The state may file a lien against your property during these 90 days.

If you do not file with the chancery court within 90 days of the assessment becoming final, you may pay the final assessment, request a refund, and then file in Chancery Court if the refund is not paid. (See Tenn. Code. Ann. Section 67-1-1802).

Our team has handled hundreds of administrative court cases. It can help your company receive the resolution you are entitled to. Get in touch with us today.

Other Tennessee Sales Tax Resources

Tennessee Sales and Use Tax - Tennessee Code Reference

Tennessee Department of Revenue Sales & Use Tax Overview

Tennessee Sales and Use Tax Rulings

Tennessee Department of Revenue Important Notices and Resources

After the Audit – Understand and Defend Your Businesses Rights

After the auditor is out of the picture, then "After the audit" section. Within that section, you can appeal with the Tennessee DOR, which is the informal protest process. Normally after the DOR appeal, you can go to admin / tax court. Tennessee is different in that they don't have that step, so you have to go to regular court, which is Chancery Court.

If you wish to contest the final assessment without making payment, you have 90 days to file suit in chancery court, either in Davidson County or in the Tennessee county where you reside or principally conduct business.

Interest will continue to accrue at the prevailing rate until payment is received. The state may file a lien against your property during these 90 days.

If you do not file suit within 90 days of the assessment becoming final, you may pay the final assessment, request a refund, and then file suit in chancery court if the refund is not paid, following the procedures outlined in the law (See Tenn. Code. Ann. Section 67-1-1802).

You are not required to request an informal conference before contesting a final assessment in court.

Here is where I found this info about the process: billofrights (tn.gov) it's on the second page of the bill of rights for taxpayers. I linked it above in this sentence: We'll cover the process of challenging a Tennessee tax assessment in detail in the following sections.

Reviews

-

"Take Control of your sales tax with easy-to-use DIY tools. Get the guidance you need - without the high cost of full-service support."

Meet David, the Auto Repair Shop Owner (DIY)

- The DIY Business Owner -

"Get expert answers when you need them. Our on-demand consulting service connects you with tax professionals for quick, reliable advice—without long-term commitments."

Meet Mark, the Business Owner Who Needs Quick Answers

- The On-Demand Consultant User -

"Outsource your sales tax headaches to proven experts. Our full-service solutions handle compliance, audits, and dispute resolution—so you can focus on growing your business."

Meet Greg, the CFO of a Multi-State Manufacturing Company

- The Managed/Enterprise CFO -

"Stay in control while getting expert help when you need it. Our guided sales tax solutions give you access to professionals for compliance, audits, and appeals—without the cost of full-service management."

Meet Kris, the Multi-Store Gas Station & Convenience Operator: Multi-Location Owner (Guided Support)

- The Guided Business Owner -

"Jerry is the best!"

Jerry is the best! I made the mistake thinking I could deal with the use tax auditor on my own not realizing that I would be ...

- Gary O. -

"Sales Tax Helper Can Make Miracles Happen"

Sales Tax Helper can make miracles happen. Jerry was able to wipe hundreds of thousands of dollars off a NY sales tax bill ...

- Zalmi D. -

"I Will Definitely Be Using His Services Again"

Jerry was very helpful and listened to all our concerns. I will definitely be using his services again.

- Joyce J. -

"Representing Our Company Professionally"

Owning a Texas car dealership is demanding work, so taking on a Texas Sales Tax Audit was a daunting task for us – we didn’t ...

- Ata A.