Nebraska Sales Tax & Audit Guide

Straightforward Answers to Your Nebraska Sales Tax Questions.

- Do I need to collect Nebraska sales tax?

- Should I be collecting or paying Nebraska use tax?

- What do I do if I should have been collecting but haven't?

- I received an audit notice. What should I do?

- Guidance on fighting a sales tax assessment in Nebraska.

Who Needs to Collect Nebraska Sales and Use Tax?

Like most states, to be subject to Nebraska sales tax collection and its rules, your business must:

1) Have nexus with Nebraska, and

2) Sell or use something subject to Nebraska sales tax.

How is Nexus Established in Nebraska?

According to the Nebraska Department of Revenue, anyone who sells taxable tangible personal property, recreational activities admissions, or the rental of lodging accommodations must obtain a sales tax permit 30 days before opening for business.

Any of the following establishes nexus:

(1) Maintenance of any business location in Nebraska, including any office.

(2) Ownership of real estate in Nebraska.

(3) Ownership of goods in a public warehouse or on consignment in Nebraska.

(4) Ownership of goods in the hands of a distributor or non-employee representative in Nebraska, if used to fill orders for the owner's account.

(5) Usual or frequent activity in Nebraska by employee or representative soliciting orders with authority to accept them.

(6) Usual or frequent activity in Nebraska by employee or representative engaged in a purchasing activity or the performance of services (including construction, installation, assembly, or repair of equipment).

(7) Operation of mobile stores in Nebraska

(8) Other miscellaneous activities by employees or representatives in Nebraska such as credit investigations, collection of delinquent accounts, and conducting training classes or seminars for customer personnel in the operation, repair, and maintenance of its products.

(9) Leasing tangible property and licensing intangible rights for use in Nebraska.

(10) The sale of other than tangible personal property such as real estate, services, and intangibles in Nebraska.

(11) The performance of construction contracts or service contracts in Nebraska.

Additionally, businesses that do not have a physical presence in Nebraska can establish economic nexus by exceeding a certain annual sales threshold.

Economic Nexus (Wayfair Law) and Internet Sales in Nebraska

A remote seller who:

- makes retail sales of tangible personal property, (all sales other than resale), including sales made through a Multivendor Marketplace Platform (MMP), in Nebraska exceeding $100,000 in the previous year or current calendar year, or

- made 200 or more separate Nebraska retail sales transactions in the prior or current calendar year.

has established economic nexus and must register with the Department of Revenue to secure a Nebraska Sales Tax Permit.

For additional information, see Remote Seller and Marketplace Facilitator FAQs | Nebraska Department of Revenue and Remote Seller State Guidance (streamlinedsalestax.org)

Small Seller Exception

Unless qualified for the small seller exception, remote sellers with no physical presence in Nebraska must collect sales tax on taxable sales made into Nebraska. Sales tax collection by remote sellers is required ONLY IF taxable sales in the state exceed $100,000 in the current or previous calendar year.

How are the $100,000 gross revenue and the 200 transaction thresholds calculated?

The $100,000 threshold is based on total Nebraska retail sales (all sales other than resale, sublease, or sub rent) in the prior or current calendar year, including sales made through an MMP. An MMP is a website or service where customers can buy goods or services from various vendors.

- The 200 transactions are based on Nebraska sales transactions in the prior calendar year or current calendar year, including sales made through an MMP.

Marketplace Facilitators and Sellers

A marketplace facilitator is an entity or person who operates an MMP. Must collect Nebraska sales and use taxes on Nebraska sales made on its marketplace.

- Marketplace facilitators with physical nexus in Nebraska must collect and remit sales and use tax.

- A marketplace facilitator without physical nexus that reaches the $100,000 threshold or the 200-transaction threshold for the first time in the current calendar year must register and begin collecting and remitting sales tax on or before the first day of the second calendar month after the threshold is exceeded.

- Payment processors chosen by a seller to handle payment transactions, such as credit or debit cards, and whose sole activity with the marketplace sales is limited to handling payment transactions between the seller and the purchaser is not a marketplace facilitator.

Marketplace Sellers

A marketplace seller is a seller that sells or offers tangible personal property or other products or services subject to Nebraska sales or use tax through a marketplace owned, operated, or controlled by a marketplace facilitator. If your business sells through Amazon or a similar marketplace facilitator, you may not have to collect sales tax on those sales.

Specifically, if the marketplace facilitator certifies that they collect and report sales tax on your sales, you are off the hook. However, such sales may still count towards your total sales threshold, meaning you’ll still need to collect tax on sales made directly through your website or any other marketplaces that don’t collect sales tax on your behalf.

See also: LEGISLATIVE BILL 284

Which Sales are Subject to Nebraska Sales Tax?

General Transactions

If you have nexus in Nebraska, the next step is determining whether the products or services you sell are subject to Nebraska sales and use tax.

Unless an item is specifically exempt, sales and rentals of tangible personal property are subject to Nebraska sales tax.

The rules seem simple, but many details make applying Nebraska’s tax rules to your business challenging. We recommend scheduling a time to review your specific situation with one of our sales tax professionals.

Common Exemptions from Nebraska Sales and Use Tax:

Exempt items include:

- Sales for resale

- Transfer of property in a change of business ownership

- U.S. postage charges on direct mail

- Coupons & Discounts

- Prescription Drugs

- Oxygen

- Substance Abuse Treatment Centers

- Livestock and Poultry Feed

- Agricultural By-Products for Manufacture or Generation of Steam or Electricity

- Agrichemical Tank Cleaners and Foam Marker

- Fungicides, Herbicides, and Insecticides

- Seeds for Planting

- Food and Food Products

- Horse racetracks

- Tele-floral deliveries

- Coal

- Electricity

- Gasoline and Combustible Fuels

- Liquified Natural Gas

- Water for manufacturing

- Magazine Subscriptions

- Coin-Operated Machines; Laundromats

- Money

- Medicines & medical equipment

- Data centers

- Motor fuels

- Biochips

- Transportation and Delivery Services. This exemption does not extend to freight and delivery charges associated with a product's sale.

- Hospital and Nursing Home Services

- Repair Services: Repairing, cleaning, altering, or restoring tangible personal property that belongs to others is a service, and the receipts for providing that service are exempt from sales tax. Tangible personal property sold or used in a repair is subject to sales or use tax.

For more details, see: Nebraska Sales Tax Exemptions | Nebraska Department of Revenue

Services

Services are generally taxed at the location where the service is provided to the customer. Refer to Sales Tax Regulation Retail Sale or Sale at Retail, and Local Sales and Use Tax Regulation Cities – Change or Alteration of City Boundaries or find the guides for specific services below:

- Labor charges to repair or replace a used, worn, or damaged part or accessory on a motor vehicle are not taxable. See If you provide repair or maintenance services to tangible personal property.

- For the taxability of other labor charges performed on motor vehicles, If you are engaged in motor vehicle towing, If you are engaged in motor vehicle painting, and If you are engaged in motor vehicle washing and waxing, and If you provide recreational vehicle (RV) park services.

- For labor charges to repair agricultural equipment, please see DOR's information guides Agricultural Machinery & Equipment" and "Well Drilling and Irrigation Industry.

- Charges for repair and installation labor are taxable when the property being repaired, replaced, or installed is taxable. See Sales and Use Tax Regulation 1-082, Labor Charges, and If you provide repair or maintenance services.

- Labor charges to install new or upgraded parts or accessories are taxable. See: If you install or apply tangible personal property.

- Charges for developing and maintaining web pages hosted by the developer or a third-party hosting entity are not taxable, even though the purchaser may be provided with passwords by the developer or third-party host to access the web page, update or delete files, create file directories, change permissions, etc.

- Several specific services and labor charges are taxed. For more details, please see: Frequently Asked Questions About Nebraska Sales and Use Tax on Certain Services and the information guide Nebraska and Local Sales Tax.

- If you are engaged in providing pest control services

- If you are engaged in building cleaning and maintenance

- If you are engaged in providing security services

- If you provide animal specialty services

- If you are providing detective services

See Revenue Ruling 01-10-2 for more information.

Software

Many people have questions about the taxability of Software as a Service (Saas).

Many states already impose a tax on software as a service. As these options proliferate, states are moving to update their tax laws and, naturally, impose a tax.

To determine whether you need to collect tax on software sales, we highly recommend contacting one of our sales tax professionals to help you sort it out.

You can find more details about Nebraska sales tax and Software as a Service here. Still, we've provided the basic information below to help you get started.

Definitions

Taxability

The gross receipts from furnishing software are taxable regardless of how it is conveyed.

- This includes services provided by a consultant that result in software transfer from

the consultant to the client.

Charges for services by a consultant that result in a transfer of software, whether canned or custom, are subject to sales tax. This includes programming, program development, systems analysis, software customization and modification, upgrading of software programs, and installation charges.

Charges for consultants who provide generalized advice only and who do not provide software or updates or modifications to software are sales tax exempt.

Charges for customer training are taxable whenever paid to the software retailer. Charges for training that are paid to a person other than the retailer of the software are exempt.

Software that alters existing software is considered separate from the existing software and is taxable.

Charges for agreements that require the seller, without additional charge or at a reduced price, to provide future enhancements, changes, or modifications, are taxable.

See Sales and Use Tax Regulation 1-088, Computer Software.

Automatic and mandatory telephone support services that come with a software transfer are taxable.

The optional purchase of telephone support services that are separately stated is not taxable.

See Sales and Use Tax Regulation 1-074, Warranties and Guarantees.

Shipping & Handling

Except for separately stated charges for U.S. postage on direct mail, shipping charges are taxable whenever the item purchased is taxable, and the charges are paid to the retailer of the item.

See Finance, Carrying, Service, and Interest Charges; and Delivery Charges.

Industry-Specific Guidance

While the general sales tax rules seem straightforward, applying those rules can get tricky when gray areas arise. The Nebraska Department of Revenue provides some specific guidance for the following industries:

- Nebraska Common or Contract Carriers

- Important Information for Contractors Performing Construction Services in Nebraska

Determining Local Sales Tax Rates in Nebraska

The Nebraska state sales and use tax rate is 5.5%. In addition, local sales and use taxes can be set at 0.5%, 1%, 1.5%, 1.75%, or 2%, as adopted by city or county governments.

Local Sales and Use Tax Tables

Click on the Sales Tax Rate Finder to find the correct state, city, and county tax rate for a specific location.

Here you can look up local Nebraska sales tax rates. Or find your city’s local tax rate in the chart below:

I Should Have Collected Nebraska Sales Tax, But I Didn't

Many of our competitors suggest Filing a Voluntary Disclosure Agreement

in each state. This is a one-size-fits-all solution that isn't always the best. Our sales tax professionals will work with you to determine your business's best and most cost-effective solution.

If you determine your business has nexus, but you have not collected Nebraska sales tax, here are your options:

1. Register and pay back taxes, penalties, and interest, or

2. Complete a VDA to cut penalties (and, in some cases, reduce your tax liability and avoid interest).

Here is what you need to know about each option to make the best decision for your business:

Option 1: Register to Pay Back Taxes, Penalties, and Interest.

A VDA is not cost-effective if the past liabilities and penalties are minimal. Sometimes the best resolution for a business is to register with Nebraska and pay back taxes, penalties, and interest.

Be wary of the tax professionals recommending a VDA in these cases. They want to make a buck rather than look out for your best interests.

When to consider registration and payment:

- If you established nexus less than 3 or 4 years ago.

- The sales tax penalty is LESS than the professional fees charged for the VDA.

- Your business does NOT have a sales tax collected issue.

Beware: Registering does not generally end past liabilities.

If you're unsure what your past liabilities are, contact us. Our state tax professionals work with you so you can make the right choice for your business.

Option 2: Voluntary Disclosure Agreement (VDA)

Nebraska's lookback period: The standard lookback period is three years.

In many situations, voluntary disclosures are a valuable tool to reduce extended periods of past exposure.

The voluntary disclosure limits the lookback period to three years. So, if you should have collected sales tax over the past ten years but didn't, you may benefit from doing a VDA.

A VDA may be a good option for you if:

- You established nexus more than 3 or 4 years ago.

- You have a sales tax collected but not remitted issue.

- The sales tax penalty savings is MORE than the professional fees charged for the VDA.

What to Expect During an Audit

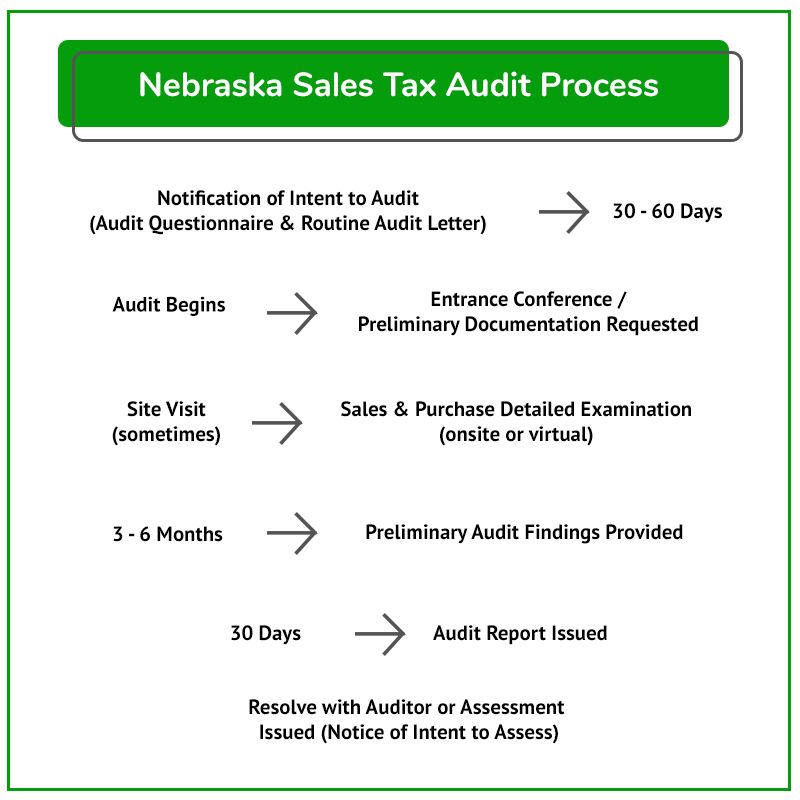

The typical audit process is shown in this flowchart. Detailed guidance for each Nebraska audit process stage follows in the sections below.

Nebraska regularly audits businesses required to charge, collect, and remit various taxes in the state. Many audits begin with a call from a Nebraska Department of Revenue sales tax auditor. Shortly after the call, your business will receive a Notification of Intent to Audit. This notification confirms that you were lucky enough to be chosen for a Nebraska sales tax audit.

A Notice of Determination stating the reason for the assessment and the amount will be sent to you by the Tax Commissioner no later than 12 months from the commencement of the audit.

It is good to start with getting a state and local tax professional involved to prepare for the audit.

I Received a Nebraska Sales Tax Audit Notice. What Should I Do?

Businesses that receive a sales tax audit notice need to consider the following questions:

- If you don’t have sales tax audit experience, how can you trust that the state's auditor abides by the rules and follows proper procedures?

- How will you know when to provide documents or when to push back?

- Do you thoroughly understand your sales and use tax areas of exposure?

- Controlling the audit is paramount to limiting exposure and shaping the results. Are you confident in doing that on your own?

Unless you can confidently answer these questions, hiring a professional is most likely to be the best option.

Contact us to learn how our sales tax professionals can give you the peace of mind and confidence you’ll need during your audit.

Visit our resource pages for more information to help you make critical decisions during your Nebraska sales and use tax audit.

The Audit Overview & Selection Process

Statute of Limitations Extensions & Issues

Managing the Sales Tax Auditor

What to Expect from a Nebraska Sales Tax Auditor

Here is a summary of the general audit process:

- The auditor will conduct pre-audit research.

- The auditor will often schedule and perform an entrance conference.

- The auditor will request records (many of which the auditor is not entitled to and does not need)

Once the auditor receives the necessary records, they will compare your Nebraska sales and use tax returns to your federal income tax returns or bank statements to determine whether you reported all applicable or gross sales on your Nebraska sales tax return(s).

NOTE: A slight error in how the tax was charged on even a single type of transaction can add up to a significant sales tax liability.

Once the auditor is confident all sales are accounted for, they will:

- Review your exempt and out-of-state sales.

- Conduct a use tax audit – the auditor will request accounts documents to ensure you adequately paid use tax on applicable purchases.

Common areas audited include:

- Advertising Expense

- Auto & Truck Expense

- Repair and Maintenance

- Office Expense

- Miscellaneous Expense

- Supplies

- Equipment

If a business buys an item online without paying use tax, the business is still obligated to remit the tax to Nebraska. Believing otherwise often leads to shocking results for the unsuspecting taxpayer during an audit. Here is more information on Nebraska Use Tax.

If you have questions about your situation, contact us to discuss it with one of our tax professionals.

After the Audit – Understand and Defend Your Businesses Rights

Upon completion of the audit, there will usually be an exit conference with the auditor. The auditor will produce an audit report with corresponding work papers to support the Nebraska sales and use tax assessment.

It is advisable to have a sales tax professional present during this meeting. This is your first opportunity to see the auditor's findings. You'll want to push back on areas where they have overstepped their bounds or misapplied Nebraska's sales tax laws.

It's best to hold off on agreeing to the sales tax assessment until a sales tax professional has reviewed it for issues that should be challenged.

| Many businesses wind up drastically overpaying the state because the business owner or in-house accounting personnel weren't well versed in the sales tax laws that, if challenged, could have reduced their sales tax liability. |

We'll cover the process of challenging a Nebraska sales tax audit assessment in detail in the following sections.

Contesting Audit Findings with the Auditor

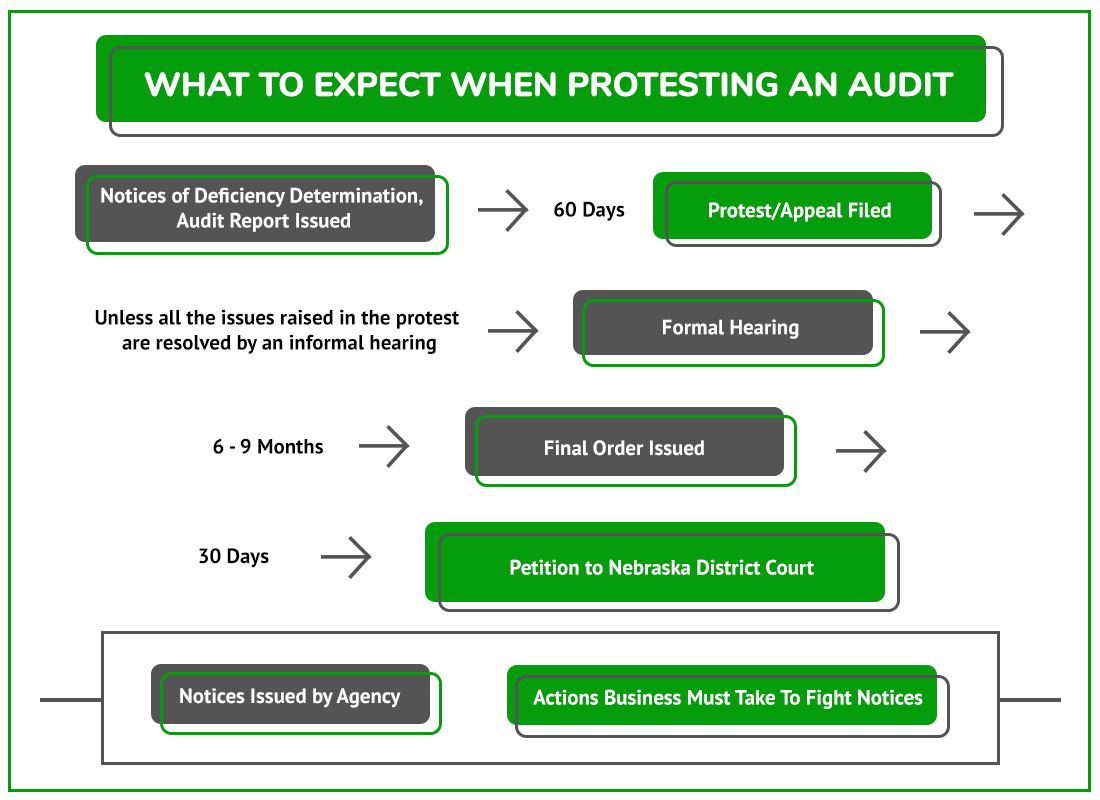

Nebraska Sales Tax Audit Protest Process Flow Chart

NOTE: If the taxpayer does not file a protest by the applicable deadline, the assessment becomes final and cannot be appealed.

See: How to Protest a Notice of Deficiency Determination or Proposed Assessment

After an audit, the auditor will issue a Notices of Deficiency Determination (AKA the audit report). It's essential to review and understand its implications carefully.

The audit report:

- Details of the auditor's findings

- Describes any proposed audit adjustments

- Shows the amount of tax, interest, and penalty due

If you disagree with the proposed changes, you may request an informal conference with the auditor. You must request an informal conference and attempt to resolve the case with the auditor.

Audit Closing Conference

The taxpayer has a short period to contest the findings with the auditor. Any issues with the results are handled as follows:

1. Issues related to exemptions, proof of tax paid, and calculations are worth addressing with the auditor.

2. Legal interpretations of sales tax law are often not resolvable at this stage.

After this conference, the auditor will adjust the audit assessment, and a Notice of Determination will be issued.

If you cannot resolve this with the auditor, the next step is to appeal/protest the issue. To dispute a notice, a taxpayer must file a Petition for Redetermination (protest).

Appeal/Protest with The Nebraska Department of Revenue

You have the right to protest, stating your disagreement with the assessment, within 30 days of the assessment.

Protest Rights and Audit Finding Confirmation

If you disagree with an audit's findings, you must file an appeal 60 days from the Notice of Determination date.

- The appeal must state why the assessment, the tax, interest, or penalties are incorrect. If the Tax Commissioner believes your statement of grounds is incomplete, you must be provided with an opportunity to perfect your statement. This statement of grounds may be filed up to 60 days after the Notice of Determination.

If you have received a Notice of Assessment and haven't talked to someone experienced in Nebraska State tax, now is the time. Do it before these deadlines are missed.

No later than nine months, plus extensions, after the statement of grounds, the Tax Commissioner must send you a Notice of Reconsideration, which states the amount of the final assessment and the reasons.

Administrative Hearing with The Nebraska Department of Revenue

Final Decision

The Commissioner must issue a decision no later than 30 days from the conclusion of the hearing.

If the taxpayer disagrees with the final action taken, the taxpayer may appeal it to the appropriate district court (usually the District Court of Lancaster County) within 30 days after the postmark date of the order or written determination.

Our team has handled hundreds of administrative court cases. It can help your company receive the resolution you are entitled to. Get in touch with us today.

Settling a Nebraska Sales Tax Liability

After any critical notices are issued, settling your Nebraska sales tax case with the Nebraska Department of Revenue is possible by filing a Nebraska Offer in Compromise. The business must meet specific criteria to qualify, but you can get better results negotiating here than with the auditor. However, knowing a fair settlement from an unreasonable settlement will be challenging without experience and knowledge of Nebraska tax laws.

DO NOT attempt to negotiate a settlement without an experienced Nebraska state and local tax lawyer or other professional.

Contest a Nebraska Jeopardy Assessment

Nebraska may issue a Notice of Jeopardy Determination in certain situations.

The jeopardy assessment gives the Nebraska Department of Revenue the right to try to collect immediately.

Due to the jeopardy nature, the taxpayer only has a very short time to contest the assessment and must place a security deposit to fight the issue.

Suppose you can't resolve the case within the agency. There's still one chance to fight your Nebraska sales tax assessment - Nebraska District Court. We don't generally recommend it, but you always have the option to skip the agency protest process and file it in tax court. Neither party wants to spend the time and resources on the uncertainty of the tax court. So, challenging the assessment can effectively maximize your settlement potential, but, at this stage, it is imperative that you have an experienced representative.

Other Nebraska Sales Tax Resources

Nebraska Department of Revenue Sales Tax Website

Chapter 9 - Local Sales and Use Tax | Nebraska Department of Revenue

Chapter 1 - Sales and Use Tax | Nebraska Department of Revenue

Nebraska Legislature - Revised Statutes Chapter 77

If you have received a Notice of Assessment and haven't talked to someone experienced in Nebraska State tax, now is the time. Do it before these deadlines are missed.

Reviews

-

"Jerry is the best!"

Jerry is the best! I made the mistake thinking I could deal with the use tax auditor on my own not realizing that I would be ...

- Gary O. -

"Sales Tax Helper Can Make Miracles Happen"

Sales Tax Helper can make miracles happen. Jerry was able to wipe hundreds of thousands of dollars off a NY sales tax bill ...

- Zalmi D. -

"I Will Definitely Be Using His Services Again"

Jerry was very helpful and listened to all our concerns. I will definitely be using his services again.

- Joyce J. -

"Representing Our Company Professionally"

Owning a Texas car dealership is demanding work, so taking on a Texas Sales Tax Audit was a daunting task for us – we didn’t ...

- Ata A. -

"Responsive and Provide Invaluable Knowledge"

Salestaxhelper.com is run by true professionals that understand the complexities of operating a multi-state business. They're ...

- Brennan A.