Texas Sales and Use Tax & Audit Guide

This guide is for businesses that need straightforward answers on the following Texas Sales and Use Tax subjects:

- Do I need to be collecting Texas sales tax?

- Should I be collecting or paying Texas use tax?

- What do I do if I should have been collecting but haven’t?

- I received an audit notice, what should I do?

- Guidance on fighting a sales tax assessment in Texas.

Who Needs to Collect Texas Sales and Use Tax?

Like most states, to be subject to Texas sales tax collection and its rules, your business must:

1) Have nexus with Texas, and

2) Sell or use something that is subject to Texas sales tax.

How Is Nexus Established in Texas?

According to the Texas Comptroller of Public Accounts, sales tax nexus is created in Texas if a business has a physical presence in Texas, such as:

- Occupying and maintaining an office, distribution center, warehouse, or physical location where business is conducted.

- Having independent sales reps, employees, or agents conducting business in the state, including selling, delivering, or taking orders for taxable items in Texas.

- Assembling, installing, servicing, or repairing products in Texas.

- Owning, renting, or leasing real property or tangible personal property in Texas, including a computer server or software to solicit orders for taxable items.

- Delivering goods to Texas customers using your company-owned or leased truck.

- Maintaining inventory in Texas using a third-party fulfillment service, such as Fulfilled by Amazon (“FBA”).

Additionally, business that do not have a physical presence in Texas, can establish economic nexus by exceeding a certain annual sales threshold in the state. See the next section for details.

Economic Nexus (Wayfair Law) and Internet Sales in Texas

Effective October 1, 2019, Texas requires that an out of state business (a.k.a. remote sellers) register with the Texas Comptroller to collect and remit sales and use tax if the business has a total sales revenue in the state of more than $500,000 in the preceding twelve calendar months.

Total sales revenue, as defined by Texas, includes the following:

- Gross revenue from all taxable and nontaxable sales of tangible personal property and services in Texas.

- Any separately stated handling, transportation, installation, and other similar fees collected by the seller in connection with the sale.

- All sales for resale and sales to exempt entities.

- As of January 1, 2020, total Texas revenue must include the aggregate sum of all sales made on all mediums, including all marketplaces and the remote seller's own website.

Once the $500,000 sales threshold is exceeded, the seller must obtain a permit and begin collecting Texas sales and use tax no later than the first day of the fourth month after the month in which the threshold was exceeded.

EXAMPLE: If during the period of July 1, 2020, through June 30, 2021, a remote seller's total Texas revenue exceeds $500,000, the remote seller needs to obtain a permit and begin collecting the appropriate tax no later than October 1, 2021.

Terminating Texas Sales Tax Collection

A common question from remote sellers regarding Texas sales tax collection is whether you must indefinitely collect sales tax after initially surpassing the economic nexus threshold. The answer is no.

Texas looks only at your businesses sales in the preceding 12 calendar months. Thus, if at any time your total sales into Texas drop below $500,000 for the last 12 months, you can terminate your collection obligation by submitting a form to the state. Be careful though, because if your sales pick up a bit, you may once again exceed the threshold, and when you do, you must resume sales tax collection by the first day of the second month after exceeding the economic nexus threshold.

EXAMPLE: You terminated your Texas sales tax collection obligation, then sales picked up and you realize that your total sales for the period of January 1, 2020, through December 31, 2020 exceed $500,000. You must resume sales tax collection on February 1, 2021.

It's also important to note that, just because you terminate your Texas sales tax collection doesn’t mean you’re 100% off the hook. Texas still requires you comply with its recordkeeping requirements and you are still subject to their sales tax audits.

Texas Sales Made Through Marketplace Providers

If your business sells on Amazon or a similar marketplace provider, you may not have to collect sales and use tax on those sales. Specifically, if the marketplace provider certifies they are collecting and reporting sales tax, you are off the hook. However, such sales may count towards your total sales threshold, potentially requiring your business to collect tax on sales made directly through your website or other marketplaces.

Which Sales Are Subject to Texas Sales Tax?

General Transactions

If you have nexus in Texas, the next step is to determine whether the products or services you sell are subject to Texas sales and use tax. Like most states, unless an item is specifically exempt, sales and rentals of tangible personal property are subject to Texas sales tax.

While the general rules seem straightforward, the application of Texas’s sales tax rules and their nuances, complexities, and application to your business can get complicated. We recommend scheduling a time to review your specific situation with one of our sales tax professionals.

Common exemptions from Texas sales and use tax:

- Groceries

- Medicines

- Common household remedies

- Many items used in farming or manufacturing.

- Newspapers

Services

Generally, services are not subject to Texas sales tax. However, the types of services listed here are subject to Texas sales tax:

- Amusement Services

- Cable Television Services and Bundled Cable Services

- Credit Reporting Services

- Data Processing Services

- Debt Collection Services

- Information Services

- Insurance Services

- Internet Access Services

- Laundry, Cleaning and Garment Services

- Motor Vehicle Parking and Storage Services

- Nonresidential Real Property Repair, Restoration or Remodeling Services

- Personal Property Maintenance, Remodeling or Repair Services

- Personal Services

- Real Property Services

- Security Services

- Telecommunications Services

- Telephone Answering Services

- Utility Transmission and Distribution Services

- Taxable Labor – Photographers, Draftsmen, Artists, Tailors, Etc.

More information on the taxability of these types of services can be found here.

Software

Texas broadly treats SaaS as part of data processing services and is subject to Texas sales tax. Likewise, software that is downloaded and digital products are taxable in Texas.

Shipping & Handling

Texas takes the position that delivery and shipping charges connected with taxable items or services are taxable. If, however, a third-party carrier charges for delivery services, it is not subject to sales tax.

Specific Industries

While the general sales tax rules seem straightforward, the application of those rules can get tricky when gray areas come up. These guides were developed by the Texas Comptroller to provide some industry specific guidance.

- Texas Sales Tax Exemptions for Agricultural and Timber Industries

- Texas Sales Tax Guide for Animal Rescue Groups and Nonprofit Animal Shelters

- Texas Sales Tax Guide for Telecommunications Services

- Texas Sales Tax Refunds for Providers of Cable Television, Internet Access or Telecommunications

- Texas Sales Tax Guide for Residential Use of Natural Gas and Electricity

- Texas Guide for Sales Tax Exemptions for Data Centers

- Texas Sales Tax Guide to Franchise Tax Exemptions

- Texas Sales Tax Guide for Licensed Customs Brokers

- Texas Sales Tax Guide to Qualified Research Exemptions

- Texas Sales Tax Guide for Remote Sellers

- Texas Sales Tax Guide for Marketplace Providers and Marketplace Sellers

Determining Local Sales and Use Tax Rates in Texas

Texas’s base or statewide sales tax rate is 6.25%. However, local taxing jurisdictions (cities, counties, special purpose districts and transit authorities) can charge a local surtax up to 2% on top of the 6.25%, potentially increasing the total sales tax that must be collected and remitted by the seller. Local surtaxes are remitted to the state as part of the Texas sales and use tax return.

Determining exactly how much tax to collect on a transaction gets really convoluted, but the basic rules are:

- If a sale is taxable in Texas, then the base tax rate of 6.25% must be charged as well as the local sales and use tax for the jurisdictions where you are engaged in business.

- The combined local taxes charged on any sale cannot be more than 2%, so the maximum tax that can be collected on a sale is 8.25%.

- Generally, local sales tax is based on the location of the seller’s place of business. Local use tax is based on the location where the customer receives the goods or services. If you ship or deliver goods to your customers, you may have to collect local sales tax, local use tax or both.

- In Texas, each taxing authority has its own boundaries, and different taxing entities can have overlapping (and sometimes conflicting) boundaries. Unfortunately, there is no logical way to determine which taxing jurisdiction a given sale is in.

- We recommend using the Texas Comptroller’s Sales Tax Rate Locator, which allows you to search for sales tax rates by address.

Combined Areas

In case you weren’t confused enough already, Texas has quite a few areas where the boundary of a local taxing jurisdiction (city, county, special purpose district or transit authority) overlaps another jurisdiction of the same type, causing the total local tax rate to exceed the 2% maximum. These overlapping boundaries are called “combined areas,” and the Texas Comptroller has special rules for sales in combined areas:

- There is not an exception to the 2% local tax maximum in combined areas, and the most tax that can be collected remains at 8.25%.

- Sellers collecting local tax in one of these areas must use the combined area local code when reporting sales and use taxes, instead of the regular city or special purpose district code. These combined areas and codes can be found here.

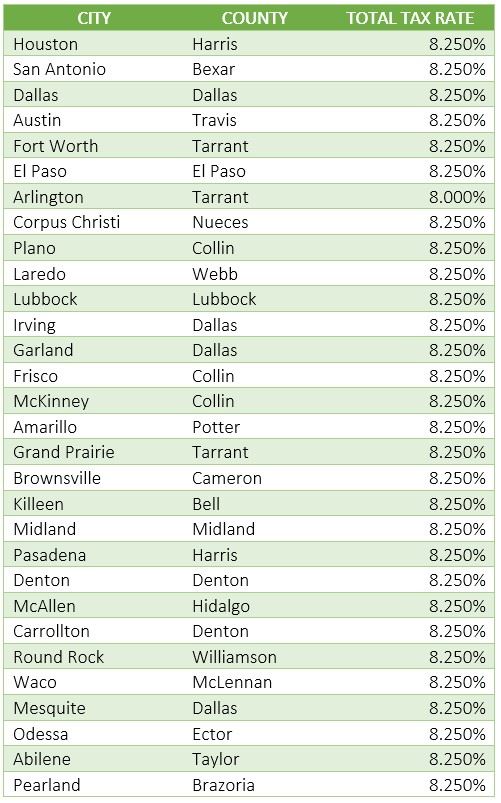

List of Local Sales and Use Tax Rates in Texas

The combined Texas state + local sales and use tax rates for the largest 30 cities are listed below. A comprehensive list can be found here.

I Should Have Collected Texas Sales Tax, But I Didn’t

Unlike many of our competitors who offer a one size fits all solution and blindly suggest filing a Voluntary Disclosure Agreement (VDA) in each state, our sales tax professionals will work with you to determine the best and most cost-effective solution for your business.

If you determine your business has nexus but you have not collected Texas sales tax, the primary options are to:

- Register and pay back taxes, penalties, and interest, or

- Complete a VDA to eliminate penalties (and in some cases reduce your tax liability and avoid interest).

Here is what you need to know about each option to make the best decision for your business:

Option 1: Register to Pay Back Taxes, Penalties, and Interest

Sometimes the best solution for a business is simply to register with Texas and pay back taxes, penalties, and interest. A VDA is not cost-effective if the past liabilities and penalties are minimal. Be wary of the tax professionals that recommend doing a VDA in these cases, they are looking to make a buck rather than looking out for your best interests. If you’re unsure what your past liabilities are, contact us and one of our state tax professionals will work with you to conduct an analysis and help you make the right choice for your business.

When to consider registration and payment:

- If you established nexus less than 3 or 4 years ago.

- The sales tax penalty is LESS than the professional fees charged for the VDA.

- Your business does NOT have a sales tax collected issue.

Beware: registering does not generally eliminate past liabilities

Option 2: Voluntary Disclosure Agreement (VDA)

Texas’s lookback period: 4 years.

In many situations, voluntary disclosures are a useful tool to reduce extended periods of past exposure. For example, if you should have been collecting sales tax for 10 years, the voluntary disclosure limits the lookback period to 3-4 years. As a result, the benefit of doing a VDA often turns on:

- Whether the VDA limits lookback period. i.e. – you established nexus more than 3 or 4 years ago.

- The sales tax penalty savings is MORE than the professional fees charged for the VDA.

- You have a sales tax collected but not remitted issue.

I Received a Texas Sales and Use Tax Audit Notice, What Should I Do?

Texas regularly audits businesses that are required to charge, collect, and remit various taxes in the state. Businesses that receive a sales and use tax audit notice should consider the following:

- Unless you have experience handling Texas sales and use tax audits, how can you trust that the state’s auditor is abiding by the rules and following proper procedure?

- How will you know when to provide documents or when to push back?

- Do you have a thorough understanding of your sales and use tax areas of exposure?

- Controlling the audit is paramount to the limiting exposure and shaping the results. Are you confident in doing that on your own?

If you are unsure of the answer to these questions and you do not have experience handling Texas sales tax audits, hiring a professional might be right for you. Contact us and learn how our sales tax professionals can give you the peace-of-mind and confidence you need during your audit.

Please visit our resource pages for more detailed information and to help you evaluate critical decisions during your Texas sales and use tax audit.

- The Audit Overview & Selection Process

- The General Audit Process

- Statute of Limitations Extensions & Issues

- Managing the Sales Tax Auditor

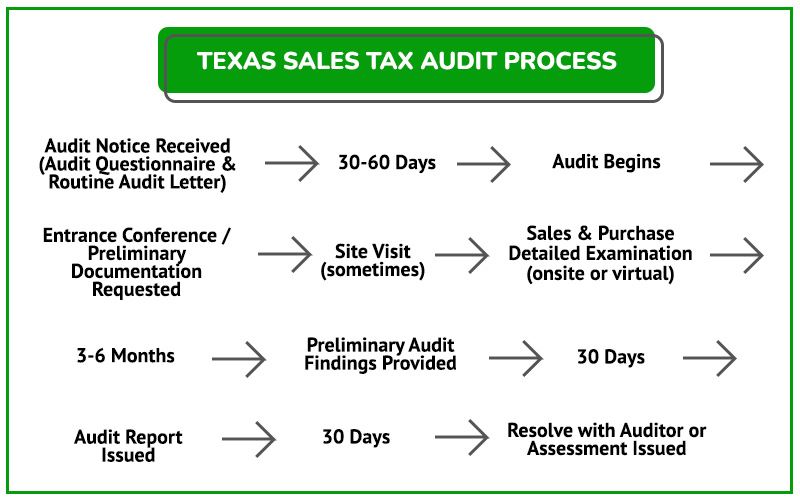

Texas Sales Tax Audit Process

The audit process usually follows the process laid out in this flowchart. See the detailed guidance for each stage of the process in the sections below.

What to Expect After You Receive a Texas Sales and Use Tax Audit Notice (Texas Routine Audit Letter)

Many audits begin with a call out of the blue from a Texas Comptroller’s sales tax auditor. Shortly after the call, your business will receive an audit notice which confirms that you were lucky enough to be chosen for a Texas sales and use tax audit. To prepare for the audit, it is likely a good idea to start by getting a state and local tax professional involved.

What to Expect From A Texas Sales Tax Auditor

- Auditor will conduct pre audit research.

- Auditor will often schedule and perform an entrance conference.

- Records will be requested (many of which the auditor is not entitled to and does not need).

What to Expect During The Audit

Once the necessary records are received, the auditor will:

- Conduct the audit by comparing your Texas sales and use tax returns to your federal income tax returns or bank statements to determine whether all applicable sales, or gross sales, were reported on your Texas sales tax return(s).

NOTE: A slight error in how tax was charged on even a single type of transaction, when multiplied over three years, can add up to a considerable sales tax liability.

- Once the auditor is confident all sales are accounted for, they will review your exempt and out-of-state sales.

- Conduct a use tax audit – the auditor will request a detail of certain documents / accounts to make sure use tax was properly paid on applicable purchases. Common areas audited include:

- Advertising Expense

- Auto & Truck Expense

- Repair and Maintenance

- Rent (including related party rent)

- Office Expense

- Miscellaneous Expense

- Supplies

- Equipment

Despite publications to the contrary, if a business buys an item online without paying use tax, the business still has an obligation to remit the tax to Texas. This often leads to shocking results for the unsuspecting taxpayer during an audit.

After the Audit – Understand and Defend Your Businesses Rights

Upon completion of the audit, there will usually be an exit conference with the auditor. The auditor will produce an audit report with corresponding workpapers to support the Texas sales and use tax assessment. It is advisable to have a sales tax professional present during this meeting as this is your first opportunity to see the auditor’s findings and push back on areas where they have overstepped their bounds or misapplied Texas’ sales tax laws.

We recommend businesses refrain from agreeing to the sales tax assessment until a sales tax professional has reviewed it for issues that should be challenged. Many businesses wind up drastically overpaying the state because the business owner or in-house accounting personnel were not well versed in the sales tax laws that, if challenged, could have reduced their Texas sales tax liability.

The process of challenging a Texas sales tax audit assessment is discussed in detail in the following sections.

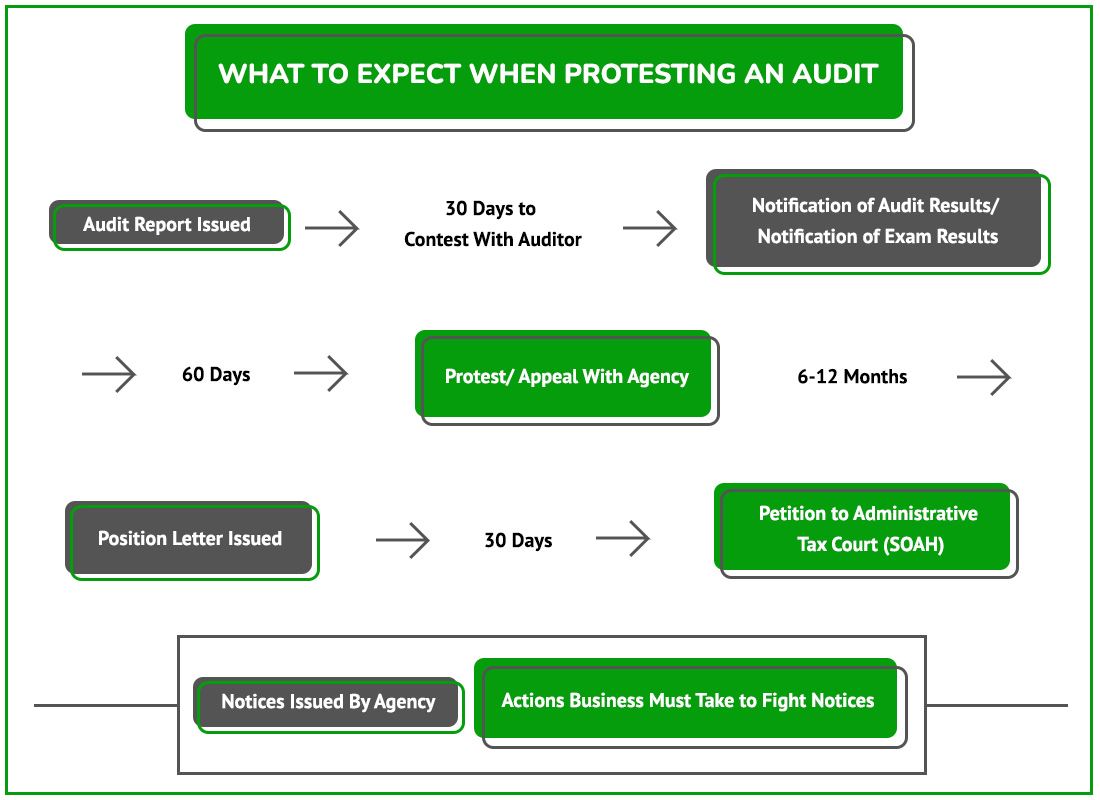

Texas Sales Tax Audit Protest Process Flow Chart

NOTE: If the deadlines are missed, you have a short period of time to pay the tax and seek a refund. If that deadlines is also missed, it can be very difficult to get case reopened.

Contesting Audit Findings with the Auditor

After an audit, the auditor will issue a Texas Notification of Audit Results (AKA the audit report). This document details the auditor’s findings so it’s important to carefully review and understand its implications. Any issues with the results are handled as follows:

- Auditee has 30 days to contest findings with the auditor.

- Documentational issues (exemption certificates, proof tax was paid, etc.) and calculations are worth addressing with the auditor.

- Legal interpretations of sales tax law are often not resolvable at this stage.

- If a resolution cannot be reached with the auditor, the next step is to appeal/protest the issue with the Texas Comptroller.

Appeal / Protest with the Texas Comptroller

Any contested issues that were unresolved prior to the audit report being issued can be protested / appealed by the auditee. This is done after the Texas Comptroller issues the Notification of Audit Results.

- A protest / appeal must be done within 60 days of the Notification of Audit Results issuance.

- If you miss the 60 days, in some cases you have may have additional time to pay the tax and file a refund claim.

- If both periods are missed, the assessment becomes final and it is very difficult to reopen the audit.

If you have received a Notification of Audit Results and have not at least talked to someone experienced in Texas State and Local tax, now is the time before these deadlines are missed.

Notice of Decision

If you cannot resolve the Texas sales and use tax dispute through the protest / appeal process, the Texas Comptroller will issue a Position Letter. The Position Letter gives you the opportunity to re-protest the assessment within the agency or file in Texas’s tax / administrative court, which is called the Texas State Office of Administrative Hearings. There are important deadlines in this phase of the process as well, such as 30 days to file in administrative court.

Texas Sales Tax Auditor Playbooks

What better way to know what the other team might have in store than to read their playbook? We can’t think of anything either. So, we compiled these links to the manuals provided by the Texas Comptroller to their auditors for conducting audits of various industries.

Some of these are loooooong and technical. So, unless you have the time, desire, and enough caffeine to study one of these, you can let us do what we do best and handle your audit for you, and you can keep your time and focus on running your business.

- Texas Sales Tax Audit Procedures – The Fundamentals

- Texas Sales Tax Audit Sampling Procedures

- Texas Sales Tax Audit Procedures for Cement Production

- Texas Sales Tax Audit Procedures for Cigarette Sales

- Texas Sales Tax Audit Procedures for Cigar and Tobacco Products

- Texas Sales Tax Audit Procedures for Contractors and Repairmen

- Texas Sales Tax Audit Procedures for Convenience Stores

- Texas Sales Tax Audit Procedures for Enterprise Zones & Qualified Hotel Projects

- Texas Sales Tax Audit Procedures for Grocery Stores

- Texas Sales Tax Audit Procedures for Hotel Occupancy Tax

- Texas Sales Tax Audit Manual for International Fuels Tax Agreement (IFTA) Software Procedures

- Texas Sales Tax Audit Procedures for Local Revenue Funds

- Texas Sales Tax Audit Procedures for Manufacturers

- Texas Sales Tax Audit Procedures for Establishments Serving Mixed Beverages

- Texas Sales Tax Audit Procedures for Fuel Sales

- Texas Sales Tax Audit Procedures for Motor Vehicles and Dealers

- Texas Sales Tax Audit Procedures for Oil & Gas Well Servicing

- Texas Sales Tax Audit Procedures for Oil Well Servicing

- Texas Sales Tax Audit Procedures for Sulphur Production

- Texas Sales Tax Audit Procedures for Telecommunications

- Texas Sales Tax Audit Procedures for Utilities Gross Receipts Tax

- Texas Sales Tax Audit Procedures for Boats and Vessels

Settling a Texas Sales Tax Liability

Along the way, or even after one the critical notices are issued, there is the possibility to settle your Texas sales tax case by negotiating with the Texas Comptroller. Often, you can get better results here than with the auditor. If you or your professional seldom does state and local tax work, it might be difficult to evaluate fair versus unreasonable settlements. DO NOT try to negotiate a settlement without an experienced Texas state and local tax lawyer or other professional.

Contest a Texas Jeopardy Assessment

Texas may issue a Notice of Jeopardy Determination in certain situations. The jeopardy assessment gives Texas Comptroller accelerated rights and it may immediately begin to try and collect. Due to the jeopardy nature, the taxpayer only has 20 days to contest the assessment and must place a security deposit to fight the issue.

Texas Administrative Court

If you cannot resolve the case within the agency or missed your deadlines, you still have one last shot to fight your Texas sales tax assessment by going to the Texas State Office of Administrative Hearings (SOAH). Although we generally don’t recommend it, you always have the option to skip the agency protest process and file in administrative court. That said, because neither party wants to spend the time and resources on the uncertainty of administrative court, continuing to challenge the assessment is often an effective way to maximize your settlement potential.

If your case is filed in administrative court, and the case proceeds to hearing, it is heard and decided by a neutral administrative law judge. Our team has handled hundreds of administrative court cases and can help your company receive the resolution it is entitled to. It is very similar to a court hearing and having an experienced representative is imperative.

Other Texas Sales Tax Resources

Reviews

-

"Take Control of your sales tax with easy-to-use DIY tools. Get the guidance you need - without the high cost of full-service support."

Meet David, the Auto Repair Shop Owner (DIY)

- The DIY Business Owner -

"Get expert answers when you need them. Our on-demand consulting service connects you with tax professionals for quick, reliable advice—without long-term commitments."

Meet Mark, the Business Owner Who Needs Quick Answers

- The On-Demand Consultant User -

"Outsource your sales tax headaches to proven experts. Our full-service solutions handle compliance, audits, and dispute resolution—so you can focus on growing your business."

Meet Greg, the CFO of a Multi-State Manufacturing Company

- The Managed/Enterprise CFO -

"Stay in control while getting expert help when you need it. Our guided sales tax solutions give you access to professionals for compliance, audits, and appeals—without the cost of full-service management."

Meet Kris, the Multi-Store Gas Station & Convenience Operator: Multi-Location Owner (Guided Support)

- The Guided Business Owner -

"Jerry is the best!"

Jerry is the best! I made the mistake thinking I could deal with the use tax auditor on my own not realizing that I would be ...

- Gary O. -

"Sales Tax Helper Can Make Miracles Happen"

Sales Tax Helper can make miracles happen. Jerry was able to wipe hundreds of thousands of dollars off a NY sales tax bill ...

- Zalmi D. -

"I Will Definitely Be Using His Services Again"

Jerry was very helpful and listened to all our concerns. I will definitely be using his services again.

- Joyce J. -

"Representing Our Company Professionally"

Owning a Texas car dealership is demanding work, so taking on a Texas Sales Tax Audit was a daunting task for us – we didn’t ...

- Ata A.